India's Inflation Update Reshapes Rate Cut Expectations

India's latest inflation series update is prompting a significant re-evaluation of rate cut predictions, with one major bank now delaying its forecast for an early easing move. The revised data...

India's economic landscape is undergoing a subtle yet profound shift, as updated inflation data prompts a reassessment of the Reserve Bank of India's (RBI) monetary policy trajectory. The latest revisions to the CPI series have led one major bank to retract its expectation for an April rate cut, pushing the debate towards a more patient approach from policymakers.

The revised inflation series, incorporating methodological updates, has injected a new layer of complexity into the rate-cut discussion. The expectation for FY2026 inflation has been nudged upwards, from approximately 3.9% to 4.1%. While seemingly minor, this adjustment carries significant implications for the RBI’s 'reaction function'. If inflation is perceived as settling closer to the target ceiling rather than comfortably below it, the central bank is likely to maintain a more cautious stance, delaying immediate easing measures. This new outlook influences the market's perspective on India's future economic direction.

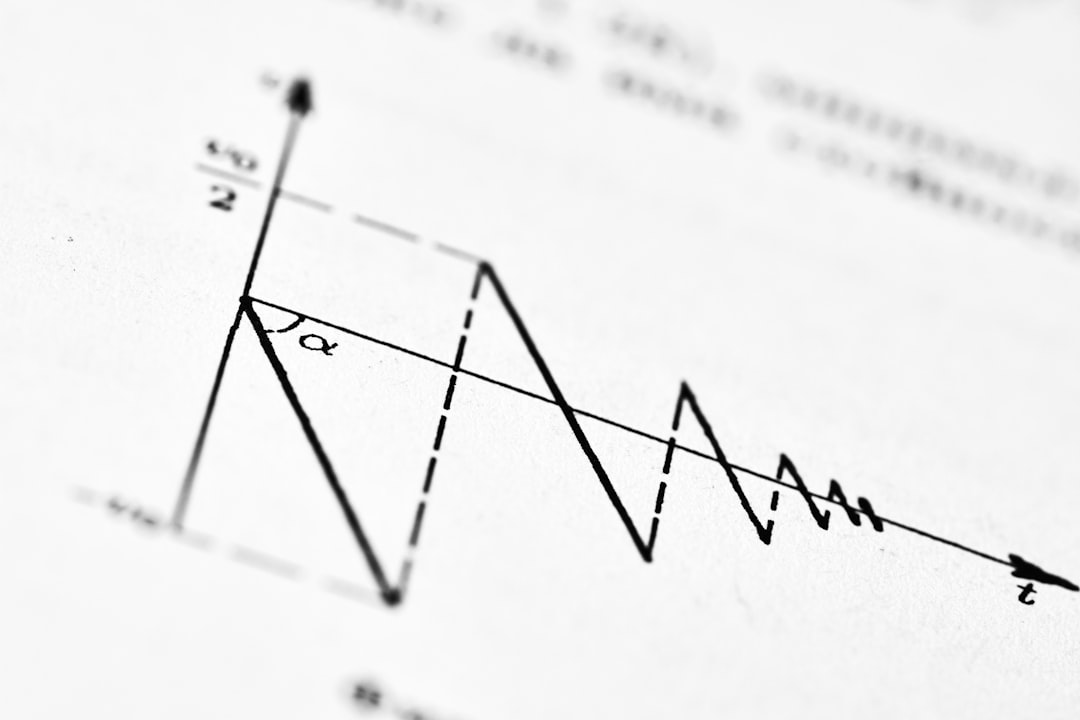

Understanding the distinction between changes in inflation levels and the broader distribution of outcomes is crucial. Minor fluctuations in data prints are less significant than their potential to alter the outlook for upcoming monetary policy meetings. The operational flexibility of a corridor-style liquidity and rate framework in India also plays a key role. Even without explicit rate cuts, the effective monetary stance can ease if overnight rates gravitate towards the lower end of the corridor, coupled with strategic liquidity management. This 'stealth easing' mechanism can foster credit growth and support duration assets without necessitating a headline policy pivot, shaping the broader financial market conditions.

Looking ahead, the market will closely monitor whether new information fundamentally alters the existing baseline or merely confirms it. This distinction is critical for driving sustained market action. The immediate focus for traders will be on how the market reacts to these shifts. Historically, when rate impulses and risk impulses align, market movements tend to be more pronounced and extended. Conversely, conflicting signals often result in choppy, mean-reverting price action. This is particularly relevant when observing the India CPI 2.75% disinflation narrative feb-12-2026, which now faces new interpretations.

A significant risk factor to watch is the potential for food inflation to re-accelerate into the summer months. Should this occur, and core inflation remains stable, it could further elevate inflation expectations, thereby restricting the RBI's policy flexibility. In a market where hedging often precedes conviction, particularly around major news events, the initial reaction can be misleading. For instance, if the market was heavily hedged against an April rate cut, its removal might trigger a relief rally rather than an immediate sell-off. Traders often examine the USD to INR live rate and analyze the USD INR chart live to gauge immediate responses to such policy shifts.

From a market implications perspective, the front end of the yield curve will be key for repricing policy expectations. Meanwhile, the long end will reflect changes in term premium. A scenario where the front end moves while the long end remains stable signals that the market is primarily pricing in policy shifts rather than broader growth concerns. However, if the long end leads the move, it often indicates concerns about confidence or supply dynamics, with broader cross-asset implications. Therefore, observing the USD INR price and any movements in the USD INR realtime data could offer early insights into market sentiment.

Commodity markets will also be affected, with their direction contingent on whether moves are driven by real yields, growth expectations, or currency fluctuations. Metals and energy typically respond to global growth prospects and developments in China, while precious metals tend to react more directly to real yields and policy credibility. Therefore, keeping an eye on the USD INR chart and the overall USD INR price live feed becomes even more critical for comprehensive market assessment.

The structural backdrop of 2026 continues to be shaped by three major forces: ongoing disinflation, the impact of fiscal and industrial policies, and the rotational shift from goods to services demand. Any data release that directly speaks to these pillars is likely to have an outsized market impact. When analyzing the Indian Rupee, market participants also track the USD INR price live to understand the immediate valuation, while a detailed USD INR live chart offers historical context during daily trading sessions. Forex traders widely use tools to obtain the accurate USD INR realtime data, which further helps in deriving the most recent USD to INR live rate. Furthermore, the Indian Rupee live chart is crucial for short-term and long-term trading strategies across various financial platforms.

Related Reading

Frequently Asked Questions

Related Stories

Korea's Business Confidence Dips: A Cautious Signal for Global Economy

Korea's business confidence index fell to 73 in February, signaling potential caution for global manufacturing and tech cycles due to its significant export mix. This dip suggests firms face...

EU Auto Registrations Rise 5.8%: A Glimmer for Europe's Economy

New car registrations in the EU saw a 5.8% year-on-year increase in January, suggesting a potential stabilization in consumer demand and industrial supply chains within Europe after a previous...

China's FDI Slump: A Red Flag for Global Confidence & Growth

China's foreign direct investment (FDI) saw a sharp decline of 9.5% year-on-year in January, a significant deterioration that raises concerns about investor confidence and long-term capital...

Brazil's Negative FDI: A Signal or Noise for FX and Rates?

Brazil's January external accounts showed a current account deficit of -$3.36 billion and a notable -$5.25 billion in foreign direct investment outflow. This raises questions about external...