UK Inflation Expectations Rise: Analyzing Second-Round Risks

UK household inflation expectations hit a three-month high in January, complicating the Bank of England's disinflation narrative.

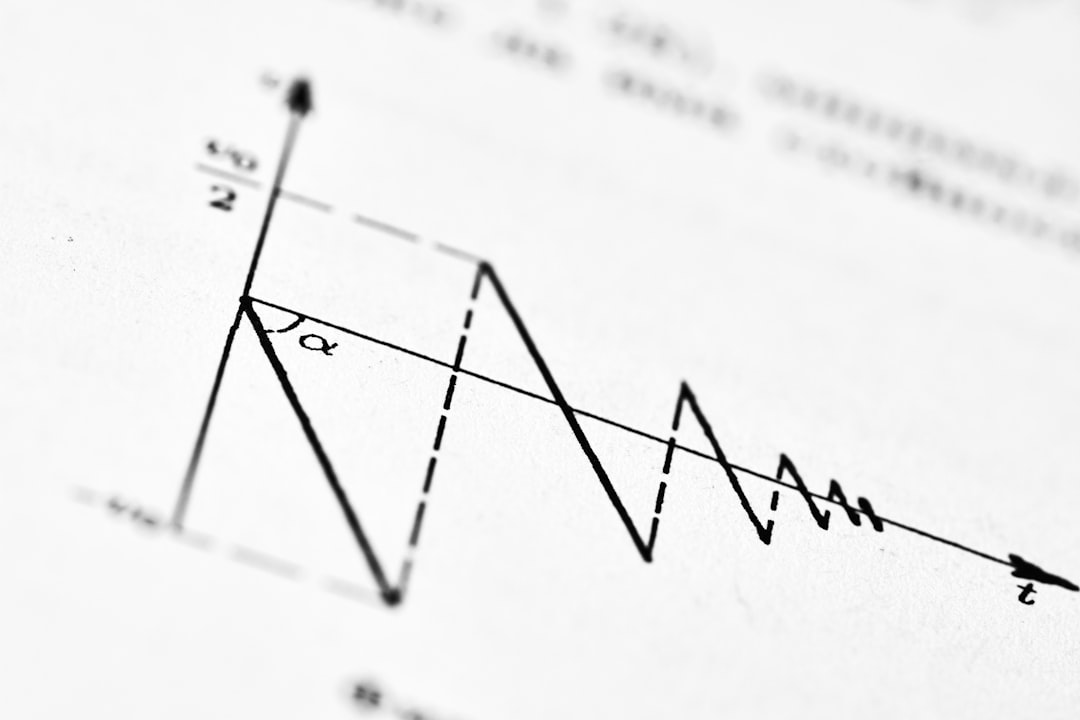

UK inflation expectations moved higher again in the latest survey snapshot, reinforcing how sensitive households remain to price levels even when the broader disinflation narrative is intact. This shift in sentiment suggests that the path toward price stability remains non-linear, as public perception often lags behind statistical improvements in headline data.

Key Numbers and Market Context

Public inflation expectations rose to a three-month high in the latest January survey reading. This comes as the official UK CPI was recorded at 3.4% in December, a slight acceleration from the 3.2% seen in November. While the GBP USD price reflects a complex interplay of global yields, domestic sentiment regarding the cost of living remains a primary driver for the Bank of England’s policy considerations.

Expectations are not just psychology; they influence wage bargaining and price-setting behavior. This is why policymakers track them as potential second-round risks. When the GBP/USD price live fluctuates, traders are often weighing whether the BoE will need to maintain a restrictive stance for longer to re-anchor these household views.

Why Inflation Expectations Matter

Elevated expectations can slow disinflation by embedding higher wage and price-setting norms. If expectations drift higher while the labor market softens, policy trade-offs become more complex: supporting growth versus re-anchoring expectations. High-visibility prices, such as food, energy, and rents, keep the GBP USD chart live sensitive to domestic data releases, even as global energy prices stabilize.

Deep Dive: How to Read This Indicator

Consumer confidence and expectations are noisy but fast. The GBP USD live chart often reacts to these prints because they serve as a leading signal for discretionary spending. Strength or weakness in the GBP USD realtime rate following a survey often depends on whether the sentiment is concentrated in lower-income brackets, which have a higher marginal propensity to consume.

According to current market structures, the GBP to USD live rate remains influenced by the persistence of services inflation. For a deeper look at how this compares to European peers, see our analysis on UK Shop Price Inflation Re-Accelerates, which highlights the surge in energy and food costs.

Transmission and Macro Translation

Clear central bank communication can stabilize expectations even without immediate policy moves. However, credibility is earned through outcomes. Markets typically map this data into the expected policy path; if the indicator signals sticky prices, the curve can bear-flatten via the front end, impacting the pound dollar live nickname pair's volatility.

The GBP USD price live is also affected by financial conditions. If markets tighten through higher real yields, the data impulse can be amplified. Conversely, if conditions ease, the signal from a single survey may fade. For those monitoring broader central bank shifts, the BoE Strategy: March Cut Debate provides essential context on the current rate-holding cycle at 3.75%.

Market Implications and Scenarios

Higher expectations can reduce conviction in rapid easing, keeping the front end of the yield curve sensitive to every subsequent inflation print. This tension is often visible in the GBP USD price as the market attempts to price in the terminal rate. Investors should cross-check these findings with upcoming wage growth and services inflation data to confirm if a trend is genuinely forming.

30/90-Day Scenario Map

- Base Case: Confidence stays weak but spending holds as long as the labor market remains stable.

- Upside Risk: Expectations stabilize and discretionary intent improves, lifting demand into the next quarter.

- Downside Risk: Labor expectations deteriorate, leading to higher precautionary saving and softer consumption.

FAQ

Why can confidence look terrible while spending holds up?

Because confidence reacts to prices and headlines, while spending reacts to cashflow. As long as jobs and wages are stable, behavior can stay resilient. The real pivot is when expectations about employment and income start to roll over.

Is one bad print enough to change the cycle?

Rarely. Two to three consecutive weak prints, especially alongside weaker labor indicators, is what tends to shift the probability distribution in a durable way.

Which subindex should I watch first?

The expectations component usually leads. The labor-market questions regarding whether jobs are plentiful or hard to get also matter because they precede changes in hiring confidence.

Related Reading

- UK Shop Price Inflation Re-Accelerates: Food and Energy Costs Surge

- BoE Strategy: March Cut Debate Intensifies

Frequently Asked Questions

Related Stories

Malaysia Exports Surge 19.6%, Reshaping Policy Timing Debate

Malaysia's latest export figures surprised significantly to the upside, posting a robust 19.6% growth, well above consensus. This unexpected surge tightens the conversation around the nation's...

Malaysia Imports Soften to 5.3%, Challenges Macro Narrative

Malaysia's latest import data, printing at a softer 5.3% against a 9.9% consensus, signals a notable shift in the economic landscape. This outcome challenges the prevailing macro narrative,...

Slovak Unemployment Rate Beats Forecasts: What it Means for Policy

Slovakia's latest unemployment rate surprised markets, printing at 5.7%, above consensus, and challenging the prevailing disinflationary narrative. This unexpected jump suggests a potential shift...

Malaysia Trade Balance Surprise Challenges Easing Timing

Malaysia's latest Trade Balance report, revealing a significant upside surprise at 21.4 Billion, has injected new dynamics into the macroeconomic landscape, potentially influencing policy easing...