Musk at Davos & SpaceX IPO Rumors: The 2026 Macro Regime Shift

A quiet regime shift is taking hold as SpaceX IPO rumors and AI robotics narratives collide with a massive surge in precious metals hedging.

Yesterday’s market tape looked calm on the surface with green indexes and steady yields, but underneath, a louder story emerged: the market is re-pricing power and policy, not just corporate profits.

Three distinct narratives are colliding in real-time. Frontier technology like humanoid robots and SpaceX IPO chatter is moving into the mainstream, while finance is becoming increasingly politicized. Simultaneously, hard assets are winning the day as gold and silver rip higher, leaving digital assets struggling to keep pace. This is the hallmark of a new market regime where hedging outcomes is becoming more important than celebrating growth.

The Market Snapshot: Risk-On Indexes, Risk-Off Undercurrents

While US equities closed higher, the internal divergence was the real "tell" for macro traders. The major benchmarks showed resilience:

- S&P 500: 6,913 (+0.55%)

- Dow Jones: 49,384 (+0.63%)

- Nasdaq: 23,436 (+0.91%)

However, silver gained over 3.6% and gold climbed nearly 2%, while Bitcoin remained flat. When stocks rise but precious metals surge significantly harder, it suggests the market is aggressively hedging against geopolitical or policy tail risks. For broader index perspective, see our US500 Analysis and US30 Analysis.

Davos Musk: Humanoid Robots as a Capex Roadmap

Elon Musk’s vision of widespread humanoid robots serves as a strategic map for capital expenditure. This isn't just a tech headline; it implies a sustained AI capex cycle involving chips, data centers, and a structural bid for energy. More importantly, it highlights a materials constraint story that benefits industrial metals like copper and silver. Robots are now a macro supply-chain narrative that keeps policymakers trapped between productivity growth and structural inflation.

SpaceX IPO Rumors: Private Market Pressure Valves

The chatter surrounding a potential SpaceX IPO—rumored to be the largest in history—is a significant liquidity event. Because the private market has become so vast, a mega-IPO of this scale acts as a benchmark for private tech valuations and a magnet for capital rotation. Traders should watch public proxies in the aerospace supply chain and defense-adjacent tech sectors, as these are likely to see increased volatility if the IPO timeline firms up.

The Politicization of Finance and Treasuries

Financial rails are increasingly becoming part of the political battlefield. Recent debanking headlines and the potential use of U.S. Treasuries as a signaling tool by foreign holders have injected a fresh risk premium into the bond market. Yields don't necessarily need a mass sell-off to gap higher; they only require a drift in credibility. Investors are now forced to hedge the stability of the rules themselves, not just the direction of interest rates.

Geopolitical Hedging: Gold vs. Crypto

The divergence between gold and Bitcoin is becoming more pronounced. Gold serves as a geopolitical and policy credibility hedge, while Bitcoin continues to trade as a liquidity-sensitive risk asset. The outperformance of hard assets indicates that we are currently in a "hedge-first" cycle rather than a clean risk-on environment. For more on precious metals positioning, review our Gold Price Analysis and Silver Market Strategy.

Macro Data: Growth and Sticky Inflation

With Q3 2025 GDP growth hitting 4.4% and PCE inflation trending at 2.7%-2.8%, the narrative of imminent Fed cuts is facing a reality check. This combination signals policy constraint rather than recession risk. In the current environment, rate cuts are a reward for disinflation that has yet to be fully earned, and the resilient economy suggests a higher-for-longer path remains the base case.

Related Reading

- US500 Analysis: S&P 500 Proxy Tests 690 Resistance Gate

- US30 Analysis: Dow Jones DIA Proxy Challenges 491 Resistance Gate

- Gold Price Analysis: Safe-Haven Bid and Real-Yield Steering Wheel

- Silver Market Strategy: Trading the Convex Macro Hedge in 2026

Frequently Asked Questions

Related Stories

EU-India Free Trade Agreement: Realigning Global Trade Flows

Analyzing the mechanical shifts in capital flows, sector winners, and supply chain de-risking as the EU and India move toward a landmark trade deal.

Ray Dalio Warns Monetary Order Is Breaking Down: Macro Analysis

Billionaire Ray Dalio declares the post-Bretton Woods system is fracturing under structural deficits and debt cycles, urging a shift toward real assets.

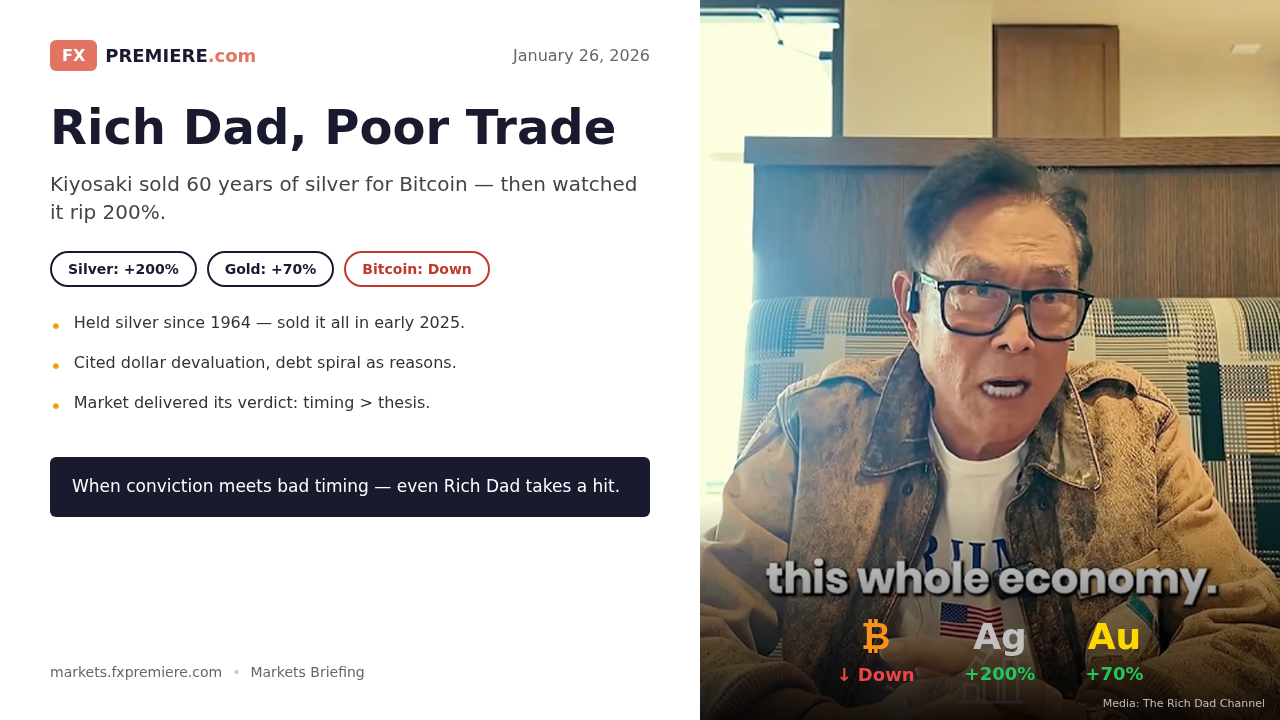

Kiyosaki’s Silver Exit: Trading the 200% Rip and Bitcoin Rotation

Robert Kiyosaki’s shift from silver to Bitcoin highlights the dangers of narrative-driven rotation as silver prices surge to $112 per ounce.

Arctic Geopolitics and NATO: Pricing the New Global Risk Regime

Investors are overlooking a structural shift in the global order as the Arctic becomes a contested front line, signaling a move from rules-based stability to leverage-based bargaining.