Yield Curve Steepness: Not Always a Bullish Signal

Despite a positively sloped U.S. yield curve, it's crucial to understand the underlying drivers of steepness. Not all steep curves signal economic recovery; some reflect heightened term premium...

The U.S. yield curve has recently shifted to a positively sloped configuration, with the 2s10s spread sitting around +65 basis points. While this might instinctively suggest an 'all clear' signal for the economy, such a simplistic interpretation risks overlooking critical nuances within the bond market. The shape of the yield curve is not a single-variable indicator but rather a complex interplay of various forces, each with distinct implications for investors and the broader financial landscape.

Understanding the current state of term premium is essential for navigating today's bond market. The front-end of the curve remains relatively anchored, largely due to the Federal Reserve's cautious approach to interest rate cuts. Conversely, the long-end of the curve bears a significant premium, reflecting ongoing fiscal and inflation uncertainties. This combination can lead to a steeper curve even when the growth outlook is not robust, presenting a 'curve trap' for unsuspecting investors. It's a reminder that a positively sloped curve can create tight financial conditions, which are not friendly for leveraged carry strategies if not properly understood.

Decoding Curve Dynamics: Bull vs. Bear Steepeners

The market distinguishes between two primary types of curve steepeners, each with different implications:

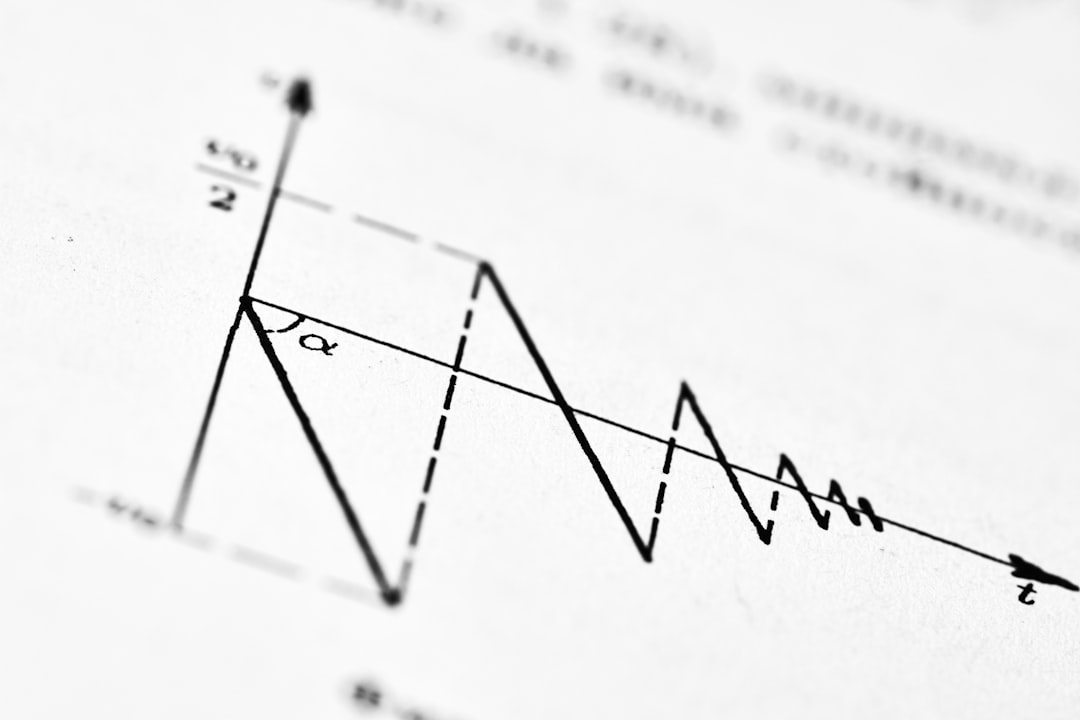

- Bull Steepener: Characterized by falling yields across the curve, with long-term yields declining more than short-term yields, causing the curve to steepen. This often signals a growth scare or disinflationary environment, where investors flock to the safety of long-term bonds.

- Bear Steepener: This occurs when yields rise, but long-term yields increase more significantly than short-term yields, leading to a steeper curve. A bear steepener typically indicates rising term premium, increased fiscal concerns, or inflation expectations, rather than an improving economic outlook.

Currently, the steepness in the U.S. curve is partially attributable to the return of term premium, as reflected in the Bond Market: Term Premium Returns. This development is not inherently bullish for risk assets; in fact, if financing conditions tighten as a result, it could even be perceived as a negative factor.

The Belly of the Curve: A Window into Policy Narrative

For discerning investors, the belly of the curve (typically 5-year to 10-year maturities) often serves as an early indicator of shifts in the policy narrative. If inflation data, such as the US CPI, comes in softer than expected, the 5-10 year segment of the curve could experience the most significant rally, signaling receding inflation fears and potentially a more accommodative Fed stance. Conversely, a hotter-than-expected CPI report might lead to the sharpest sell-off in the 2-5 year segment, as expectations for earlier rate cuts are pushed back. Notably, the US CPI: Front-End Trapped illustrates the immediate impact of inflation data on different parts of the curve.

Key Metrics to Monitor

To accurately assess curve mechanics and avoid the 'curve trap,' traders should closely monitor several key indicators:

- 5s30s Spread: Further steepening of this spread suggests an increase in term premium, indicating growing investor concerns about the long-term outlook.

- Long-End Auctions: The demand and pricing at long-end bond auctions provide critical insights into investor acceptance of the prevailing term premium. Strong demand implies confidence, while weak demand might signal a challenge to current pricing.

- Real Yields: Real yields, which account for inflation, are invaluable diagnostic tools. If real yields rise, it can put downward pressure on risk assets, even if the nominal curve appears steep. This highlights why focusing on real yields as the diagnostic is crucial for understanding the true cost of money.

The current 10Y TIPS real yields around 1.79% indicate where money can be parked in the safest assets available to investors for a US10Y price live asset. When watching bond auctions, observing whether investors accept the term premium is key to determining market sentiment.

Trading Implications: Navigating the Uncertainty

The core takeaway is to avoid interpreting curve steepness as an automatic 'green light' for risk assets. Instead, it should be viewed as a clue—a signal about which risk premium is currently being priced into the market. A steep curve can indeed be a recovery signal, but it can equally represent a bill for uncertainty, passed on to borrowers and investors. Thus, a more strategic approach involves focusing on which part of the curve price is driving moves and using real yields as a definitive diagnostic tool.

To guard against the curve trap, where a steep curve misleads investors about duration's safety, it's vital to respect auction outcomes, especially in the long end. For a concise dashboard metric, observe whether the 5s30s spread steepens on days without significant macroeconomic data releases. This quiet steepening often indicates a pure expression of term premium talking, devoid of immediate policy or growth catalysts. For instance, the Inflation vs. Growth: Bond Market Regimes article further explores how different macro regimes impact bond market dynamics.

Mini Case Study: Steepness in Different Market Tapes

Consider how steepness manifests under two distinct market conditions:

- Tape A: Inflation Scare: In this scenario, yields rise across the board, with the long end leading and the 5s30s spread steepening. Real yields also climb, causing risk assets to struggle due to increased discount rates and tighter financing conditions.

- Tape B: Growth Scare: Here, yields fall, but the front-end declines less than the long end, leading to a steepening curve driven by a rally in bonds. Breakeven inflation rates often soften. While risk assets may still face challenges, bonds tend to provide better hedging in this environment.

The market can rapidly transition between these 'tapes.' This volatility underscores why focusing on real yields and identifying curve leadership is more reliable than merely observing the sign of the curve. The DE10Y 2.76% and FR10Y 3.353% spreads live further illustrate these dynamics in European fixed income markets. The long bond leads amid soft data, which signals term premium unwind, as detailed in Long Bond Leads Amid Soft Data.

Post-CPI Checklist

After any significant data release, particularly CPI, a focused checklist can help clarify the market's response:

- Which maturity segment of the curve moved first, and by how much?

- Did real yields or breakeven inflation rates account for the majority of the move?

- Did the US dollar's movement confirm the bond market's narrative?

By systematically addressing these questions, investors can gain a clearer understanding of the day's market dynamics without falling prey to overly complicated or misleading narratives about the us10y rate, us10y realtime, or the US 10 year bond yield. The US 10-year live chart shows the intricate movements in these rates.

Market Snapshot: 13 February 2026

As of today, the market presents the following key figures:

- US Curve: 2Y 3.46% | 5Y 3.67% | 10Y 4.109% | 30Y 4.74%

- Real Rates: US10Y TIPS 1.79% (10Y breakeven ~2.32%)

- Europe: DE10Y 2.76% | FR10Y 3.353% | IT10Y 3.379% | ES10Y 3.14%

- Japan: JP10Y 2.21%

- Risk Inputs: DXY 97.039 | VIX 21.11 | WTI 62.71 | Gold 4972

Related Reading

- Bond Market: Term Premium Returns: Supply Drives Yield Dynamics

- US CPI: Front-End Trapped, Back-End Negotiating Duration

- Inflation vs. Growth: Navigating Two Trades in One Bond Market

- Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.