Canada 10-Year Yields Navigate US Long End Influence

Canada's 10-year government bond yields are currently trading smoothly, though they remain heavily influenced by movements in the US long end, with oil prices adding an inflationary tailwind.

Canada's 10-year government bond yields are holding steady today, largely contained by domestic institutional activity. However, underlying this calm is a conditional stability, highly susceptible to volatility emanating from the US long-end bond market. With crude oil prices adding an inflationary tailwind, the Canadian bond market is poised for potential shifts.

US Long-End Dynamics Driving Canadian Yields

The Canadian 10-year (CA 10Y) yield currently stands at 3.4250%, experiencing a modest increase of 0.0150 points. This movement is occurring within a tight daily range of 3.4170% to 3.4320%. While domestic institutions are actively dampening volatility, the Canada bond market exhibits a significant 'global beta', meaning it often follows the direction of larger global benchmarks, particularly the US Treasury market.

Notably, the US 10-year (US 10Y) yield is up 0.0270 points to 4.2650%, and the US 30-year (US 30Y) yield has seen a more substantial rise of 0.0390 points, reaching 4.8940%. This cheapening of the US long end frequently translates into upward pressure on Canadian yields, a dynamic often observed as a gradual grind rather than an abrupt jump. For those tracking CA 10Y realtime shifts, understanding this interconnectedness is key.

Inflationary Tailwinds from Oil Market and Broader Economy

Beyond direct correlation with US yields, the Canadian bond market is also contending with inflationary pressures, particularly from the energy sector. WTI Crude Oil (Mar) is trading at 63.75, up 0.31%, with a range between 62.63 and 63.90. This sustained strength in oil prices adds an inflation tail overlay that could limit any significant rallies in bond prices, thereby keeping yields elevated. We monitor the CA 10Y chart live to contextualize these external drivers.

The broader cross-asset tape shows a DXY (US Dollar Index) at 97.15, down 0.49%, while the VIX, a measure of market volatility, is up 4.17% at 17.03. This combination of a weakening dollar and rising fear index suggests a nuanced environment where inflation concerns could persist despite other market movements. Investors looking at the CA 10Y to USD live rate might consider these underlying market forces.

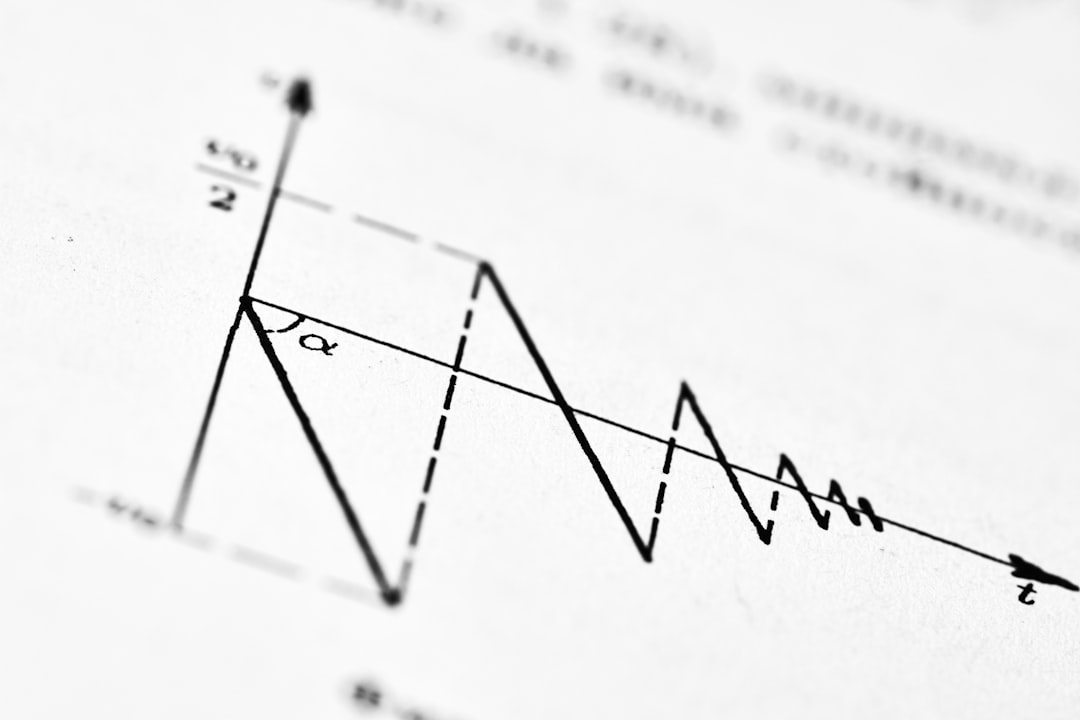

Tactical Map for CA 10Y Yields

For immediate tactical positioning, the pivot point for the CA 10Y yield is identified at 3.425%. A critical decision band lies between 3.420% and 3.429%, representing a narrow 1.5 basis point range for traders. We often see the CA 10Y price live reacting sharply around these levels.

- Above 3.429%: A move above this level would signal that the US term premium is actively pulling Canadian yields higher. The next reference point to watch is 3.432%, where further upward momentum could be confirmed.

- Below 3.420%: Conversely, a drop below this band would indicate a stabilization bid, suggesting a potential short-term reversal or consolidation. The immediate support level to monitor is 3.417%.

Execution strategies should anticipate repricing windows, especially around the New York handover, a period known for increased liquidity and potential volatility. Market participants should be prepared for rapid adjustments in the CA 10Y price during these times.

Key Influences to Watch Over the Next 24 Hours

Several factors could influence the direction of Canadian bond yields in the coming 24 hours:

- Bank of Canada (BoC) communication shifts: Any unexpected hawkish or dovish comments from BoC officials could significantly impact market sentiment and yield expectations.

- US 30-Year direction at NY open: Given the strong correlation, the opening moves in the US long bond market will be a primary determinant for Canadian yields. What happens to the US 30Y chart live is crucial.

- Oil follow-through: Continued upward pressure or a significant reversal in crude oil prices will either reinforce or alleviate inflation concerns. Keeping an eye on the WTI price live is essential.

- Domestic data surprises: Any unexpected Canadian economic data releases, particularly related to inflation, employment, or GDP, could prompt a reassessment of the BoC's policy path.

- Housing and credit stress signals: The health of Canada's housing and credit markets remains a persistent concern. Any emerging signs of stress could impact borrowing costs and bond yields.

Monitoring these variables will be essential to accurately forecast short-term movements in the Canadian bond market. The interplay between domestic stability and international market forces creates a dynamic environment for bond investors. We continue to track the CA 10Y price live for any significant developments.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.