Credit's New Wrapper: CLO ETFs and the Hunt for Carry Amid Macro Shifts

This analysis delves into the emergence of CLO ETFs, the dynamics of duration warehousing, and the nuanced interplay between growth momentum and bond market volatility. We explore tactical trading...

The financial landscape is continuously evolving, and the emergence of new credit wrappers like CLO ETFs reflects a persistent demand for yield in a complex macro environment. Today's market movements, characterized by a softer dollar and contained equity volatility, suggest a nuanced interplay between growth momentum and inflation impulses, where credit's new wrapper plays an increasingly important role.

Market Snapshot: Undercurrents of Change

Looking at the market snapshot, key indicators suggest a period of adjustment rather than a dramatic shift. The US10Y price live is currently at 4.161%, experiencing a slight dip, while the US2Y price live shows a more noticeable decline. These movements indicate a market that is recalibrating expectations. The DXY, or dollar index, remains largely unchanged, with the VIX showing a minor but meaningful decrease, signaling a degree of calm in equity markets. Commodities like WTI crude oil and Gold are also seeing slight adjustments, keeping the immediate inflation picture in check. This environment highlights how sensitive bond markets are to every snippet of news.

The Whispers of Growth: Duration and Volatility

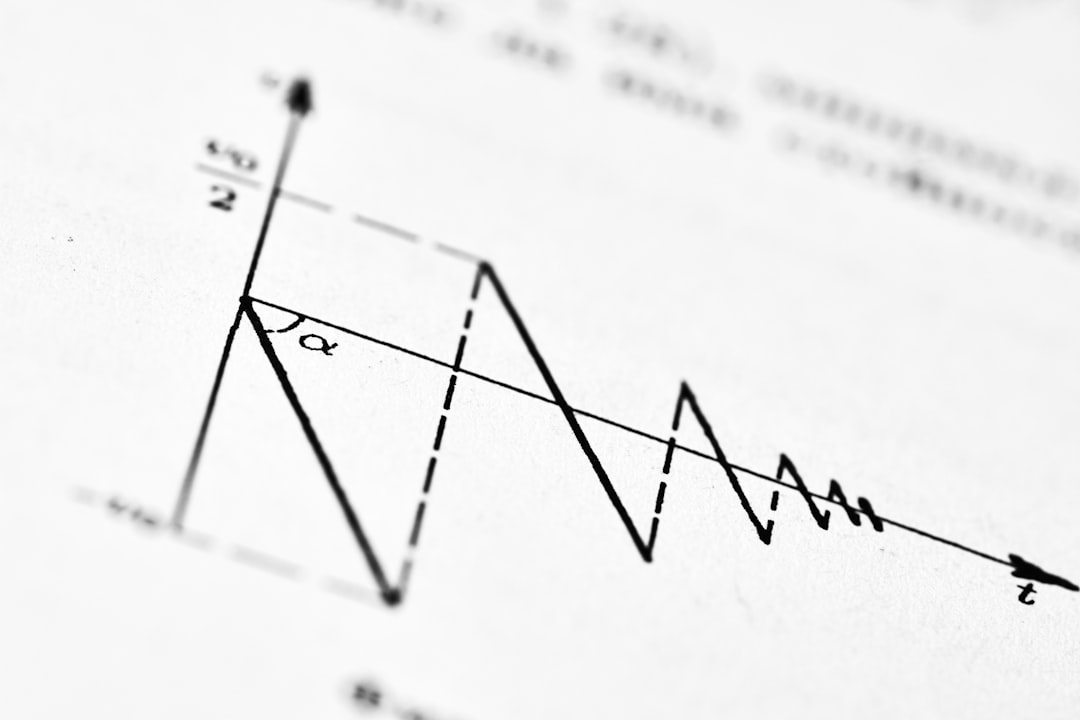

While the market is not 'screaming recession,' there's a clear 'whisper' about the importance of marginal growth momentum. A softer dollar combined with contained equity volatility and slightly lower oil prices are collectively working to prevent an immediate re-acceleration of inflation. This subtle shift impacts how market participants warehouse duration. The long end of the yield curve acts as a 'volatility valve,' responding more dynamically to changes in sentiment and expectations. Today's price action appears to be more about a tactical risk premium adjustment than a wholesale re-evaluation of the entire policy path. The tell-tale sign is the leadership from the long end of the curve, with the front end remaining relatively stable or 'anchored.'

Key View: Regime vs. Catalyst

A disciplined approach to trading requires distinguishing between a 'regime' and a 'catalyst.' In a range-bound regime, mean reversion strategies often prove effective. Conversely, a trend regime demands patience, requiring clear 'acceptance' and time confirmation before sizable positions are taken. It's crucial for traders to avoid mixing narratives; for instance, a duration long position initiated due to wobbling growth concerns should not morph into a fiscal protest trade. These are fundamentally different approaches, hedging distinct risks and requiring their own unique analysis. The behavior of the US10Y chart live reinforces this need for clarity, as different market interpretations can lead to varied trading outcomes.

What to Watch Next: The Road Ahead

Over the next 24 hours, several key indicators will warrant close attention. The behavior of spread products in Europe will serve as an essential 'carry-risk barometer,' offering insights into regional credit conditions. Auction performance, particularly any signs of 'concession building,' will provide clues about investor demand for new debt issuance. JPY moves will act as a 'BOJ/curve tripwire,' given the Bank of Japan's pivotal role in global monetary policy. Finally, the shape of the yield curve – whether it's steepening or flattening – will offer crucial 'tells' about the prevailing market regime. These factors collectively indicate the potential for continued, albeit cautious, re-evaluation of market risk and policy implications. Investors are constantly watching the US10Y realtime data for signs.

Deep Dive: Credit Wrappers and Duration Rallies

The rise of new credit wrappers like CLO ETFs typically follows periods of persistent demand for yield. These vehicles provide a new avenue for investors to access credit markets and capture carry. A stronger credit bid facilitated by these wrappers can, paradoxically, cap the depth of duration rallies. By channeling demand into credit products, CLO ETFs can help keep 'recession probabilities' contained, as investors are willing to take on credit risk for enhanced returns. This dynamic creates a continuous feedback loop: as yield demands drive innovation in credit products, the resulting stronger credit bid influences broader bond market dynamics. The availability of diverse mechanisms for capturing carry means that the overall fixed-income market remains resilient, even as subtle shifts in growth momentum occur. Understanding the nuances of the US10Y live rate and its interactions with other instruments is paramount in this landscape.

Related Reading

- Hedged Yield, Dollar, and Bond Market Dynamics Amidst Mixed Signals

- Bond Market: Front-End Skepticism on Rate Cuts Amid Policy Path Adjustments

- Bond Market Volatility: The Hidden Rate Tightener and What It Means

- JGBs: March Hike Talk Meets a Still-Reluctant Curve

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.