Inflation Linkers: Gold & Oil Rise, Breakevens Poised for Action

Gold and oil prices are on the rise, signaling potential shifts for inflation-linked bonds. This analysis explores the factors driving breakeven rates and what traders should watch next.

Inflation-linked bonds, or 'linkers,' are once again in the spotlight as key indicators like gold and oil prices show an upward trajectory. This movement suggests that inflation expectations, often reflected in breakeven rates, may be due for a significant re-evaluation by the market.

Understanding the Drivers: Gold, Oil, and DXY

Today’s market snapshot reveals notable shifts across crucial instruments. The US 10Y nominal yield stands at 4.2650%, while the UK 10Y nominal yield is 4.5650%, and the DE 10Y nominal yield sits at 2.8530% – all showing modest increases. Commodities, however, are exhibiting more pronounced strength. WTI crude oil (Mar) is trading at 63.75 (+0.31%), indicating sustained energy demand or supply concerns. More significantly, Gold (Apr) price live is seeing a substantial jump of +1.15%, trading at 5037.11. This surge in gold, often considered a safe-haven asset and inflation hedge, alongside rising oil prices, is a classic signal for inflationary pressures. Concurrently, the DXY, which measures the US dollar's strength against a basket of currencies, is down 0.49% at 97.15. A weakening dollar typically makes dollar-denominated commodities, like gold and oil, cheaper for international buyers, further fueling their price increases.

Why Linkers and Breakevens are Critical Now

Linkers serve as a barometer for inflation uncertainty. When commodities experience upward momentum and the dollar takes a hit, breakeven rates — the difference between nominal and inflation-indexed bond yields, representing the market's inflation expectation over the bond's life — usually begin to reprice. This repricing occurs even if broader economic growth figures remain static. The pivotal question for market participants revolves around whether real yields also climb. Should real yields increase, the duration of bonds, particularly nominal ones, remains vulnerable, impacting their overall return. Traders should always consider gold price as a key indicator.

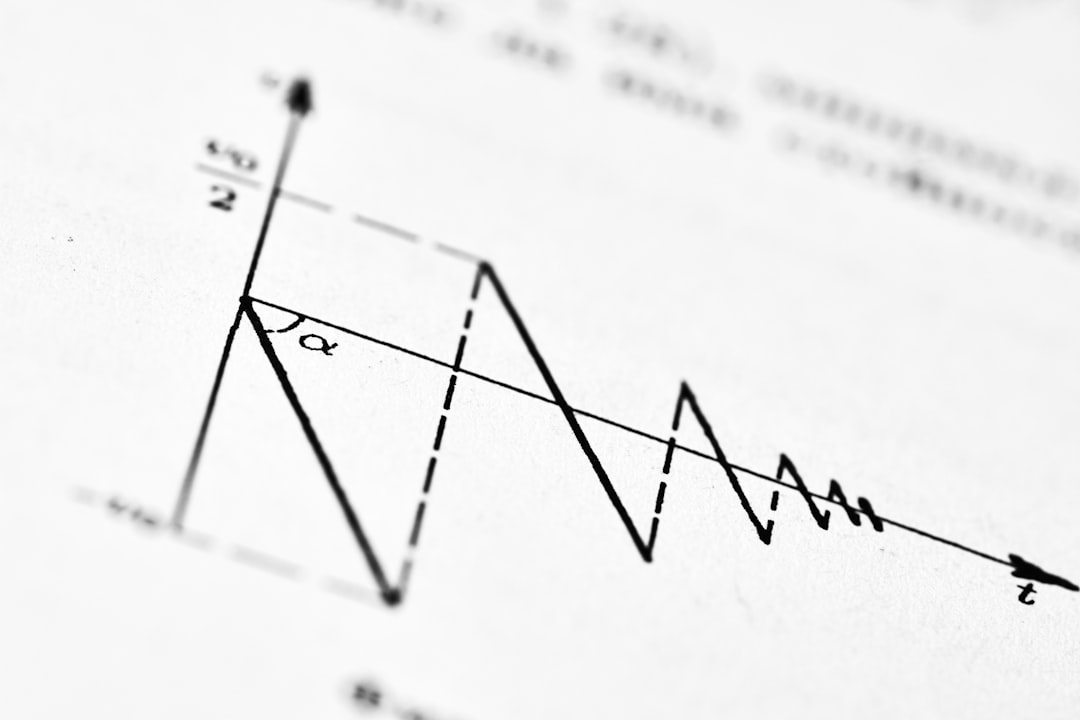

The Two-Step Pattern of Breakevens: Impulse and Validation

The movement in breakevens often follows a two-stage process. Initially, there's an 'impulse' driven by factors like oil price movements and currency fluctuations – such as the current WTI (Mar) price live and the DXY's weakening. The second, and equally crucial, step is 'validation.' This validation typically stems from confirming data points, such as sustained wage growth, broader services inflation, or a definitive reaction from central banks regarding their monetary policy stance. Without this subsequent validation, any initial widening of breakeven rates can quickly dissipate, leading to short-lived market reactions. Observing gold chart behavior and WTI chart live can provide early insights into these impulses.

Practical Positioning and Risk Management for Linkers

For investors considering inflation linker exposure, a key piece of advice is to size positions judiciously to withstand a potential 'real-yield shock.' Many historical drawdowns in linker performance have not been due to inflation expectations declining, but rather from an unanticipated surge in real yields. This emphasizes the importance of managing duration risk. Furthermore, the liquidity of linkers, particularly in less active market conditions, should be a significant consideration in any investment strategy. A comprehensive gold live chart provides historical context for these movements.

What to Watch Next in the Coming 24 Hours

The immediate outlook for inflation linkers hinges on several critical factors. Firstly, observing whether the current energy price increase transforms into a sustained trend or proves to be a temporary spike is paramount. Gold realtime movements will also be closely tracked. Secondly, confirmation of rising wage and services inflation will provide the necessary validation for prolonged breakeven widening. Thirdly, potential 'central bank pushback' – any hawkish rhetoric or action aiming to curb inflationary expectations – could introduce significant volatility. Lastly, the direction of real yields will serve as a definitive regime tell for the broader market. The gold to USD live rate is a crucial metric to monitor, as is WTI realtime performance, especially with upcoming UK inflation data showing sensitivity to these dynamics. Investors should closely follow the gold price for signs of enduring inflationary pressure.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.