Europe Inflation Outlook: Sticky Services Gating ECB Policy Shift

Analyze the divergence between cooling headline inflation and persistent services pricing in the Eurozone and its impact on FX markets.

The European inflation debate has shifted from a broad-based surge to a nuanced battle of composition. While headline inflation figures have moderated toward central bank targets, the persistence of services inflation remains a formidable hurdle for policymakers considering a pivot.

The Composition Problem: Goods vs. Services

Goods disinflation has done most of the heavy lifting in bringing down broad price indices, but the domestic economy tells a different story. In the current regime, the EURUSD price live environment reflects a market navigating this 'hold' stance. Policymakers are understandably rational in their caution; the cost of premature easing is a potential inflation rebound, whereas the cost of waiting is merely a slower growth trajectory. As traders watch the EURUSD chart live, the focus remains on whether services and wages can provide a decisive cooling sequence.

Why Services Persistence Dominates the Macro View

Services prices are the ultimate anchor for medium-term durability because they reflect domestic wage growth and corporate pricing power. Until these components soften, a hawkish bias lingers. For those tracking the EUR/USD price live, any upside surprise in services data can reprice interest rate expectations with significant asymmetric risk. Consequently, the EUR USD live chart often reveals volatility clusters around wage and negotiated pay announcements, as these are the leading indicators for the next policy phase.

Market Regimes and Cross-Asset Signals

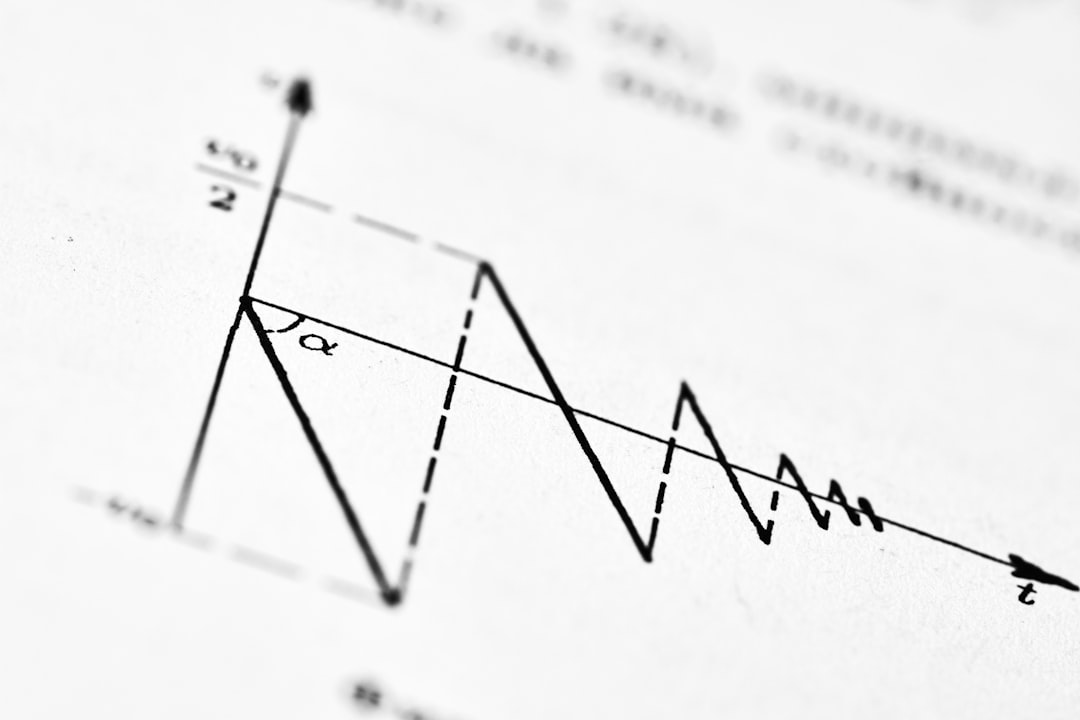

In a landscape where inflation is near target but sticky, the EUR USD chart live is influenced more by marginal changes in the policy path than by old news. We observe that EUR USD price action often represents a second-order expression of the rates impulse. When evaluating the EUR USD realtime feed, traders must separate the initial price shock from the actual propagation across the EUR to USD live rate. This data-dependent environment suggests that the euro dollar live rate will likely remain in range-bound territory until labor market slack becomes evident.

Key Variables to Watch

- Services Inflation: The primary gauge for persistence.

- Wage Growth: Negotiated pay measures will dictate the ease of justification for future cuts.

- Survey Components: Early warnings for potential price re-acceleration.

Ultimately, the first market move following a data release is often information rather than absolute truth. High-confidence opportunities typically emerge once follow-through demand is confirmed. In this 'hold' regime, the balance of risks—specifically the description of labor-market slack and core persistence—matters more than the baseline projection itself.

Related Reading

- ECB Policy Risk: How Currency Strength Impacts Financial Conditions

- Mapping Macro Signals: Central Bank Holds and Inflation Tests

Frequently Asked Questions

Related Stories

US Existing Home Sales Decline: Affordability Bites

US existing home sales dropped 8.4% in January, signaling that restrictive monetary policy continues to impact real activity. This slowdown highlights persistent affordability challenges and...

Global EV Registrations Dip: A Signal of Policy Uncertainty

Global EV registrations saw a 3% year-on-year drop in January, primarily driven by policy uncertainty in major economies like the US and Germany, signaling broader implications for industrial...

Japan CPI Easing: BoJ's Tightening Path in Focus

Japan's core CPI likely eased to around 2.0% in January, a development closely watched by the Bank of Japan as it navigates its normalisation path. While the headline figure moderates, the focus...

India's Inflation Update Reshapes Rate Cut Expectations

India's latest inflation series update is prompting a significant re-evaluation of rate cut predictions, with one major bank now delaying its forecast for an early easing move. The revised data...