The Trillion-Dollar Rotation: 5 High-Growth Sectors for 2026

Institutional capital is shifting toward infrastructure-heavy sectors. Discover why robotics, energy, and orbital logistics are the dominant trades of 2026.

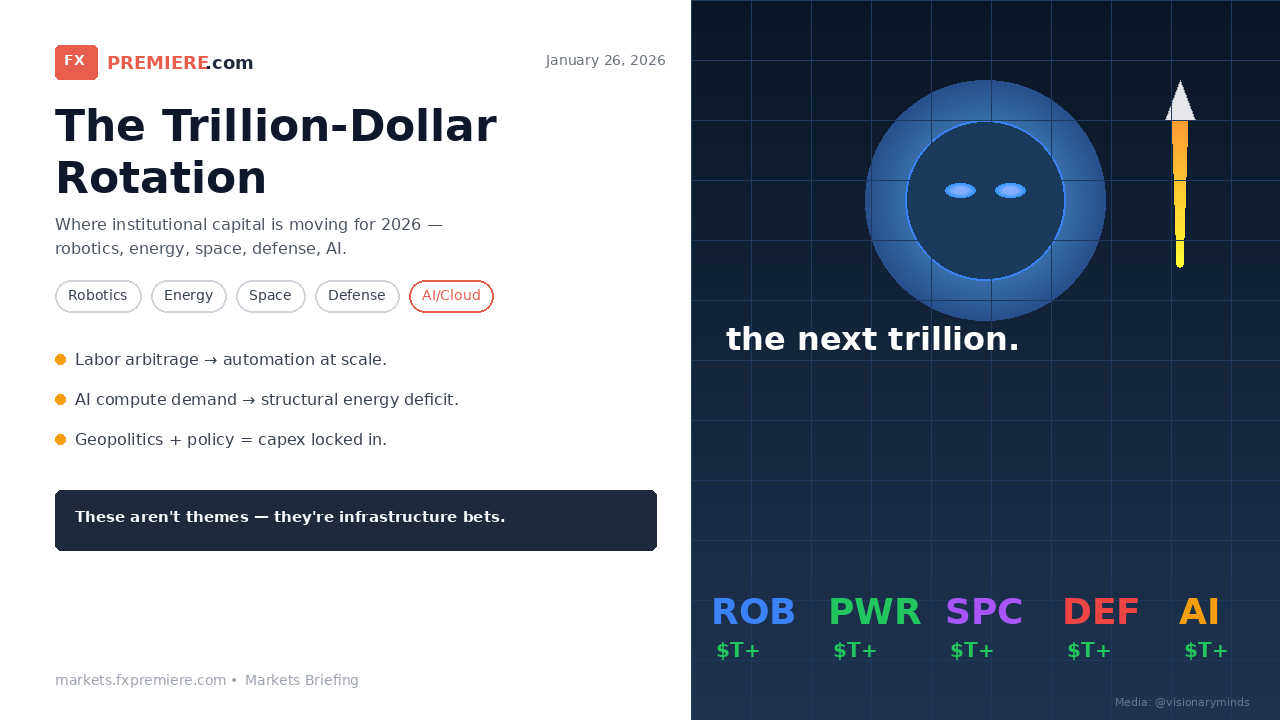

In the evolving financial landscape of 2026, institutional allocators are moving away from speculative froth and toward the structural backbones of the global economy. This shift, often described as a trillion-dollar rotation, is focusing capital into five specific pillars: automation, energy, space, defense, and cloud computing.

The Infrastructure of Tomorrow: 5 Key Sectors

1. Robotics and the End of Labor Arbitrage

Human labor is no longer the primary variable in the cost of production; it is being replaced by scalable automation. From factory floors to last-mile logistics, the transition is accelerating because the unit economics of robotics have finally surpassed human parity. For traders monitoring the technology tape, keeping a close eye on the TSLA price live is essential, as the development of the Optimus platform remains a bellwether for the entire humanoid robotics industry. These systems do not strike or demand raises, making them the ultimate hedge against wage inflation.

2. Energy: The Hidden Cost of Artificial Intelligence

AI's rapid expansion has a major prerequisite: massive electricity consumption. Every large language model query requires significant wattage, and data centers are becoming the most consistent customers for power plants. This has sparked a renaissance in nuclear energy and grid modernization. Analysts often look at the XAUUSD price live as a gauge for macro stability, but in 2026, energy infrastructure is competing for that same safe-haven capital as a tangible asset play. The winners in this space are those capable of delivering baseload power at scale to satisfy the insatiable hunger of compute clusters.

3. Space: Securing the New High Ground

Orbital logistics, satellite internet, and space-based data storage are no longer speculative concepts. With the barrier to entry dropping, the Total Addressable Market (TAM) for space is expanding into the trilions. Governments are increasingly writing checks for lunar logistics and earth observation. For those following the broader tech market, analyzing how megacaps integrate these capabilities into their ecosystem is vital, much like how investors track NVDA price live to understand the compute demand for satellite-linked AI systems.

4. Defense and Geopolitical Structuralism

Global tensions are proving to be structural rather than cyclical. Modern defense budgets are pivotally shifting toward drones, autonomous platforms, and AI-enhanced intelligence. This sector is characterized by long procurement cycles and locked-in government commitments. As defense spending scales, the XAUUSD chart live often reflects the underlying geopolitical risk premium, yet the defense companies themselves represent the operational way to trade this persistent instability.

5. AI and Cloud: The Widening Moat

The winners of 2025 are solidifying their positions in 2026 as cloud spend accelerates. We are currently in the heavy capex phase where the compute moat is widening for hyperscalers. To navigate this, many professionals utilize an XAUUSD live chart to balance their risk-on tech exposure with precious metals, though the earnings visibility in cloud remains exceptionally clear. In this environment, monitoring NVDA chart live becomes the shorthand for gauging the health of the entire digital transformation cycle.

Macro Setup and Institutional Positioning

What connects these sectors is a combination of capital intensity and favorable policy tailwinds. Whether it is reshoring mandates for robotics or defense expansion, these are not mere "themes"—they are multi-year capex commitments. Traders must ensure they have access to an XAUUSD realtime feed or NVDA realtime data to spot the moments when institutional flows begin to shift between traditional safe havens and these high-growth infrastructure plays.

The mistake common to retail participants is entering a trade once the narrative has already peaked. By observing the XAUUSD live rate alongside the NVDA live rate, sophisticated investors can identify where capital is flowing and where it is being withdrawn. The 2026 market is less about the next meme stock and more about recognizing where the next trillion dollars in infrastructure spending is already being deployed.

Market Execution and Risk

As you build your 2026 portfolio, remember that while these sectors have the highest conviction flows, execution remains key. Using a gold live chart can help you manage volatility during earnings season for these high-beta sectors. Whether you are looking at a gold price spike or an NVDA live chart breakout, the objective is to stay ahead of the rotation. Always monitor the gold chart for signs of macro exhaustion, as these infrastructure plays require a stable credit environment to flourish. Ultimately, gold live bids will continue to act as the primary barometer for the global liquidity that fuels this trillion-dollar rotation.

Related Reading

- Pelosi Portfolio Disclosure: Trading Megacap Optionality in 2026

- NVIDIA (NVDA) Earnings Strategy: Trading the Revision Impulse

- Alphabet (GOOGL) Q4 2026 Earnings Strategy: Trading the Capex Bridge

- Gold Strategy: Safe-Haven Regime Accelerates Above $5,000

Frequently Asked Questions

Related Stories

Rates & Commodities Drive Markets Amid Macro Swings

A deep dive into today's crucial market drivers, focusing on the interplay between inflation trends, Treasury supply, and commodity dynamics. Learn how these factors are shaping currency and...

The Cost of Resilience: How Reshoring & Stockpiling Reshape Markets

Explore how policy-driven reshoring and stockpiling are subtly reshaping global supply chains, elevating unit costs, and influencing market dynamics across commodities, manufacturing credit, and...

Sector Rotation: Quality Cyclicals vs. Duration Amidst Macro Shifts

Investors are currently favoring cash flow and balance-sheet strength, leading to a significant sector rotation with implications for energy, tech, financials, and utilities. This shift emphasizes...

Bitcoin Under Macro Scrutiny: Trading Near $66,466 Amid Policy & Liquidity Shifts

Bitcoin is trading near $66,466, heavily influenced by broader macro liquidity and central bank policies, with the upcoming CME Group 24/7 crypto derivatives launch adding another layer of complexity.