Bond Market: Liquidity's Dominance & The Microstructure Trap

Today's rates tape points to liquidity and microstructure influences driving bond movements, with risk premium compression in play. Understanding the distinction between range and trend regimes is...

The rates market today is demonstrating classic risk-premium compression, driven by specific microstructure dynamics rather than a fundamental shift in rate expectations. Front-end pricing remains sticky, while longer-duration assets attract bids, particularly when economic growth data softens and the dollar weakens.

Liquidity vs. Levels: Understanding Today's Rates Action

The current market snapshot reveals nuances that traders must heed. For instance, the US10Y is trading at 4.161%, reflecting a slight dip from its daily highs, while the DE10Y is at 2.7899%. This indicates a pattern where the initial price movement may not fully capture the underlying forces. What's truly critical is not just the absolute levels, but how liquidity is influencing these shifts. The market's microstructure—the underlying supply and demand dynamics—is arguably more influential than the headline yield figures alone.

Our analysis suggests that today’s price action is less about a wholesale rewrite of the long-term policy path and more about a risk premium adjustment. This is particularly evident in the long-end leadership, where duration assets are outperforming, while the front end remains relatively anchored. Traders must observe this dynamic closely as it signals a nuanced response to recent economic data prints. For those tracking Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind, this aligns with an easing of growth concerns bidding up longer-dated treasuries.

Reading the Tape: Signals from the Yield Curve

To decode the current bond market, particularly in fixed income, paying close attention to the The Curve Whisper: 2s10s Inverted but Message Changing is essential. The 5s10s segment of the yield curve offers one of the cleanest signals. When both the 5-year and 10-year yields rally in tandem, it typically signals broader concerns about economic growth. Conversely, if only the 10-year yield rallies, it often points to technical factors such as supply dynamics or hedging flows. Currently, we observe movement indicating increased demand for duration, suggesting growth concerns are overshadowing purely technical pushes.

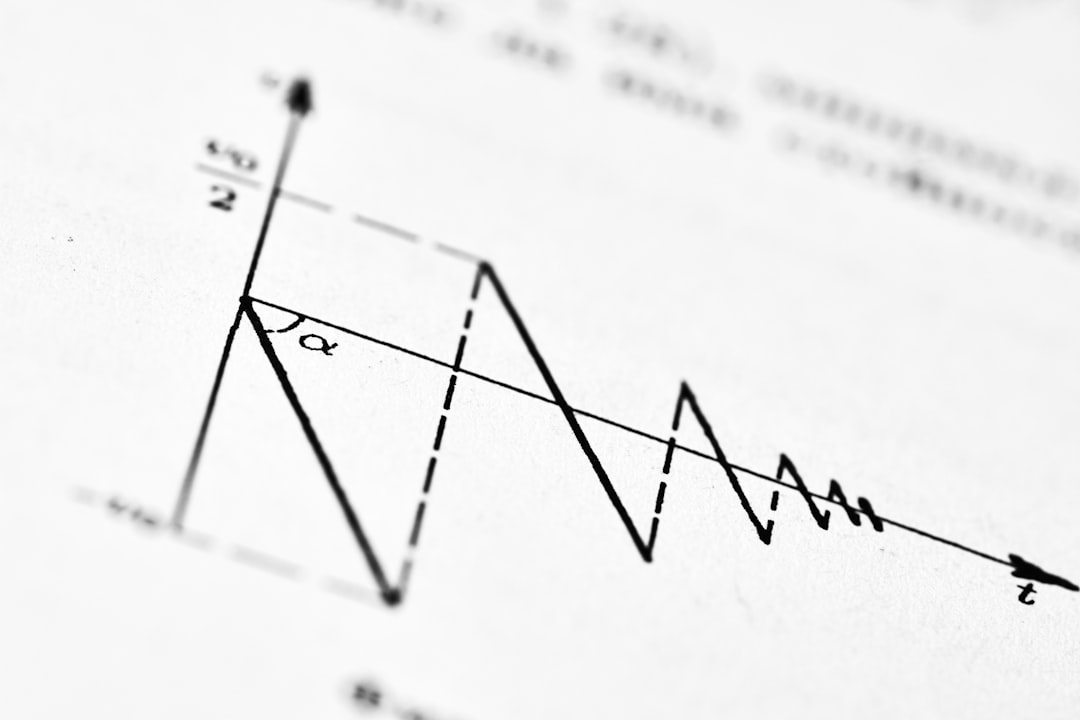

For traders, separating the prevailing market regime from specific catalysts is paramount. In a range-bound regime, mean reversion strategies often prove effective. However, in a trend-driven environment, patience and confirmation are key before increasing position size. Mixing these narratives, such as treating a strategic long-duration position (driven by growth wobbles) as a fiscal protest trade, can lead to misaligned hedging strategies and sub-optimal outcomes.

Key Watchpoints for the Next 24 Hours

The direction of the usd jpy price live will be crucial, as a sustained DXY softness will reinforce bids for duration. The dollar's trajectory, reflected in the DXY's movement, is a significant barometer for bond market sentiment. Any considerable JPY moves could serve as an important tripwire for Bank of Japan (BOJ) policy or overall global curve dynamics. Additionally, monitoring spread behavior in Europe, particularly within bond markets, will provide insights into prevailing carry-risk appetites. Traders can also gauge the market's underlying regime by observing the shape of the yield curve – whether it's steepening or flattening – as this reveals more about longer-term expectations and liquidity flows than any specific Bond Market Volatility reading.

US10Y Price Live: What the Data Reveals

The us10y price live currently sits at 4.161%. When looking at the real-time data, it's evident that tactical trading decisions are heavily influenced by these figures. The dxy realtime at 96.692, showing a slight dip, indicates a weakening dollar which often correlates with a bid for bonds. Moreover, the vix realtime at 17.21, down 2.49%, signals a slight easing of market volatility, making bonds relatively more attractive. The us10y live rate changes throughout the day, driven by evolving market conditions and macroeconomic news flow. Monitoring the us10y chart live provides a visual representation of these shifts, allowing for faster interpretation of market dynamics.

Understanding Bond Market Drivers

The narrative around bond markets is complex, often involving a blend of macroeconomic factors and technical trading behaviors. The constant interplay between economic data, central bank policy expectations, and global geopolitical developments keeps the bond market highly sensitive. Investors following us10y price changes need to consider the broader context, including auction performance and any early signs of concession building, which indicate how new supply is being absorbed. This is particularly relevant when considering the impact of events that might affect the us10y to dollar live rate or overall treasury market. The underlying us10y price chart live will often reflect shifts in these core drivers, providing invaluable insights for market participants. The current conditions exemplify how Fiscal Slippage: The New Baseline for Bond Term Premium can influence prices.

Related Reading:

- Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind

- The Curve Whisper: 2s10s Inverted but Message Changing

- Bond Market Volatility: The Hidden Rate Tightener and What It Means

- Fiscal Slippage: The New Baseline for Bond Term Premium

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.