Bond Market: Dissecting Term Premium Unwind & Volatility

Today's bond market sees a compression of risk premium with the long end leading, signaling a term premium unwind rather than a drastic repricing of the policy path. Traders should differentiate...

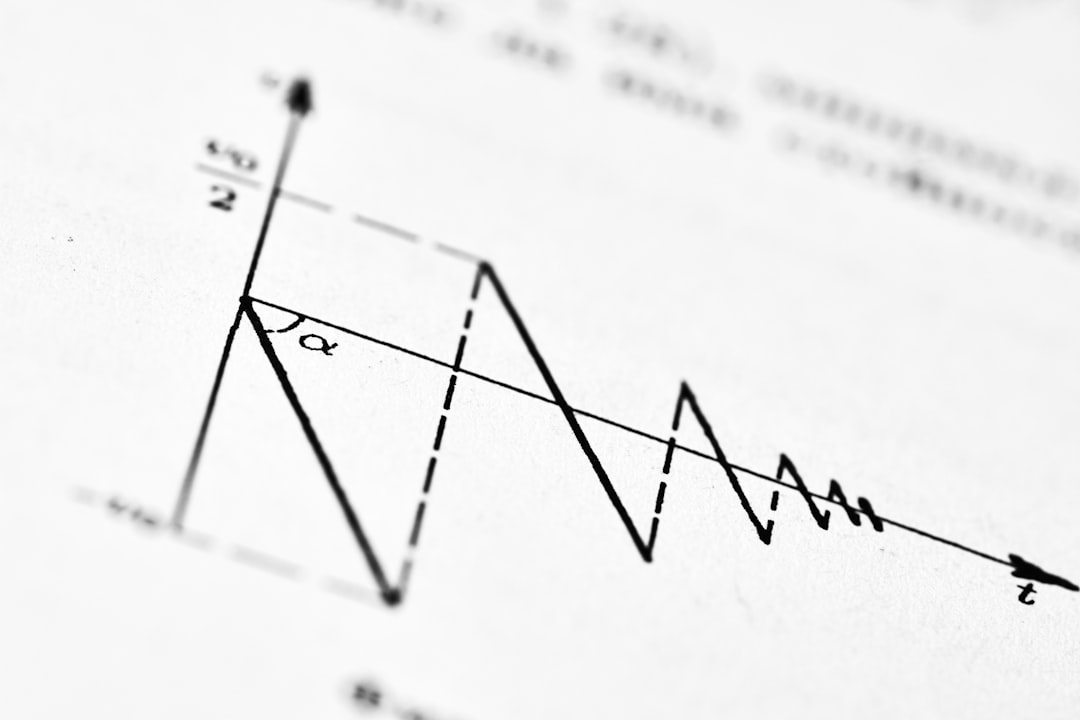

The bond market is currently exhibiting a fascinating dynamic, characterized by a compression of risk premium where the long end of the curve is catching a bid, while front-end yields remain relatively sticky. This behavior suggests a term premium unwind is largely at play, rather than a fundamental shift in the anticipated policy path. Understanding this distinction is crucial for navigating bond market volatility in the current environment.

Market Snapshot and Dynamics

Today's trading session reveals a classic case of risk-premium compression across the rates tape. For instance, the US10Y is currently at 4.161%, down slightly, while the US2Y is at 3.460%, also showing a modest dip but remaining anchored relative to the long end. This price action, combined with a slight dip in the DXY to 96.692 and a decreased VIX at 17.21, paints a picture where duration is finding buyers.

To fully grasp these movements, it's helpful to compartmentalize the bond market into three distinct buckets: policy (influenced by the 2-year yield), macro balance (reflected in the 5-year to 10-year yields), and term premium (affecting 20-year to 30-year yields). The current market dynamic primarily indicates a term premium unwind in the longer-dated instruments, rather than a significant re-evaluation of short-term policy interest rate expectations. This distinction is vital for bond market participants, as it implies the market is adjusting for risk compensation over the long horizon, not necessarily signaling imminent changes in central bank policy.

Key Takeaways and Trading Philosophy

A critical aspect for traders is distinguishing between a market's regime and its catalysts. In a range-bound regime, mean reversion strategies often prove effective, capitalizing on prices returning to their average. Conversely, in a trend regime, successful trading necessitates clear acceptance of new price levels and time confirmation before increasing position size. Confusing these regimes can lead to suboptimal decisions and increased risk exposure.

It's important to avoid mixing narratives when constructing trading hypotheses. For example, if you're taking a long position in duration due to wobbling growth concerns, resist the urge to overlay it with a fiscal protest trade narrative. These are distinct analytical frameworks, each with its own set of underlying drivers and hedging considerations. The bond market volatility today asks traders to be precise in their rationale.

What to Watch in the Next 24 Hours

Looking ahead, several factors will be crucial in shaping the bond market's trajectory over the next 24 hours:

- European Spread Behavior: Keep a close eye on spread behavior within European bonds, as this can serve as a potent barometer for carry-risk sentiment. Traders might want to consider how the BTPs vs. Bonos narrative evolves.

- Volatility (VIX): Observe whether the VIX stays suppressed or if there's a re-acceleration. A surge in volatility could signal a broader shift in risk appetite.

- Curve Shape: The shape of the yield curve – whether it steepens or flattens – will provide critical clues about the prevailing market regime. This will affect how traders interpret the 2s10s inverted curve dynamics.

- JPY Moves: Any significant movements in the Japanese Yen (JPY) should be monitored, as it acts as a key tripwire for potential Bank of Japan interventions or shifts in global interest rates. We often see JPY moves acting as an early warning for broader currency market shifts, impacting even crypto pairs like the USDJPY price live.

- Dollar Direction: Sustained softness in the DXY would likely reinforce the duration bid in fixed income, making the dollar direction a pivotal indicator. For instance, a weakening dollar could support a further bid in EUR USD realtime, affecting euro dollar live rates.

Deep Dive into Bond Movements

Significant moves in the bond market frequently originate from a combination of positioning and a catalytic event. It's essential to watch for asymmetry in market reactions: does negative news cause a disproportionately larger move in yields compared to positive news? This divergence can highlight where market participants are particularly vulnerable or 'trapped' in their current positioning. The EUR USD price today reflects a complex interplay of these factors. Moreover, understanding how the EUR to USD live rate is influenced by these macro factors is key.

For those tracking specific bond instruments, pay attention to US10Y realtime data to gauge true directional conviction. The EUR USD chart live offers a visual representation of how these narratives are playing out in real-time. Observing the EUR/USD price live helps in assessing the immediate impact of market news and central bank sentiments. Furthermore, the EUR USD price live changes provide continuous insights into market sentiment. These real-time data points are crucial for a comprehensive understanding of the bond and currency markets. The EURUSD price live feed is an indispensable tool for active traders, as is keeping an eye on the EURUSD price live chart. Keeping informed on the US10Y live rate offers a direct look at the underlying cost of capital.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.