China's Bond Market: A Global Shock Absorber Amidst Volatility

Despite low yields, China's government bond market is emerging as a crucial global duration shock absorber, offering low correlation in volatile regimes.

In an increasingly interconnected global financial landscape, the role of diversified assets as safe havens becomes paramount. While traditional havens like U.S. Treasuries and German Bunds remain popular, China's government bond market is carving out a unique niche, not for its high yields, but for its potential as a global shock absorber. With China 10Y trading around 1.788% as of February 13, 2026, its low correlation to other major bond markets offers a compelling diversification tool for investors navigating market volatility. This strategic significance is particularly apparent when global risk sentiment sours, prompting investors to seek stability.

Why China Matters to Global Duration

When global risk perceptions shift, the scramble for safety often leads investors to familiar low-risk assets. Historically, these have included U.S. Treasury bonds and German Bunds, sometimes complemented by gold price. However, China's government bond market is increasingly entering this conversation, primarily due to its distinct characteristic of low correlation during specific market regimes. Unlike the high yields offered by some emerging markets, China's 10-year yield, hovering around 1.8%, presents a stark contrast to the U.S. 4.109% handle.

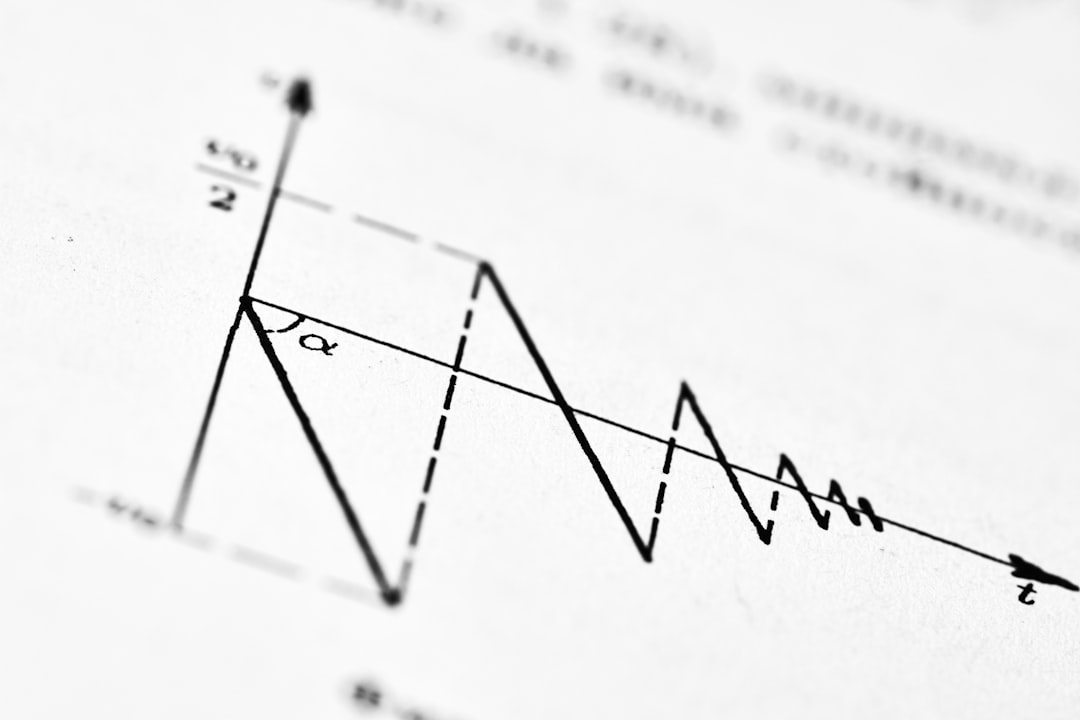

This yield differential is precisely why shifts in global capital flows can dramatically impact appetite for Chinese duration when risk sentiment and FX expectations are in flux. The market functions as a 'volatility sink', providing a stable-yield environment that can effectively reduce overall portfolio volatility during periods of global growth scares. However, in aggressive risk-on, carry-seeking phases, its performance may lag.

The Macro Backdrop and FX Implications

China's robust external accounts, evidenced by a substantial current account surplus in late 2025, indicate a structural bid for domestic assets. This allows China to finance its domestic needs largely independently of foreign capital inflows, reinforcing its capacity to maintain a yield curve dictated more by policy objectives than by external funding pressures. However, the currency channel remains a critical gatekeeper for foreign investors. Despite the allure of a low-correlation asset, the FXPremiere Macro Strategy team emphasizes that USD/CNH price live movements can dominate the investment outcome. If there isn't strong conviction in currency stability, the bond yield becomes a secondary consideration.

Our View: Dissecting the Opportunity

1. Not 'Free Money': China’s low yields aren't a direct path to superior returns for foreign investors. Currency fluctuations can significantly erode or amplify gains, making FX stability a prerequisite for an attractive investment. This means that a stable dollar opens the door for diversification flows, while a stronger DXY tends to dampen foreign interest in low-yield local duration.

2. Volatility Sink: The market's primary global role is to absorb volatility. In moments of global growth uncertainty, a stable-yield market like China's can substantially de-risk portfolios. Conversely, during periods of heightened risk appetite and carry-seeking behavior, its relative performance might be subdued.

3. Policy Divergence: Divergent monetary policies between major economies, for instance, the U.S. discussing rate cuts while China prioritizes growth support and financial stability, will reshape the relative value landscape. This divergence further underscores the importance of the currency channel as the key determinant for foreign capital flows. For global macro strategies, China bonds should be seen as a diversification tool rather than an aggressive rates trade.

Tactical Implications and What to Watch

For strategic asset allocation, China's government bonds offer a valuable diversification tool. While they may not provide outright high rates across the yield curve, their low correlation to other global duration assets makes them attractive for reducing overall portfolio risk. For emerging market allocators, China acts as an 'anchor' that can temper risk, albeit potentially at the cost of higher returns during bull markets elsewhere. For investors focused on bond term premium returns, understanding this dynamic is crucial.

Moving forward, investors should closely monitor: China's policy messaging regarding growth targets, changes in capital controls and market access regulations, and trends in the dollar's quiet pivot. A rising DXY (Dollar Index) typically reduces foreign appetite for low-yield local duration, as the cost of carry increases and currency hedging becomes more expensive.

In conclusion, China’s duration doesn’t need to be high to exert significant influence on global portfolios. Its true value lies in its stability and low correlation when the rest of the world grapples with uncertainty and volatility. The country's substantial external surplus further solidifies its capacity to maintain a domestic yield curve aligned with policy objectives, reducing the probability of external funding shocks. However, the market undeniably transmits risk through the currency, necessitating careful consideration of FX exposures and Ethereum (ETH) price live impacting broader market sentiment.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.