EM Local Bonds: Carry, FX Risk, and US CPI Impact

Emerging Market local bonds offer attractive yields, but their appeal is deeply intertwined with currency stability and global risk appetite. This analysis explores how FX risk can negate carry...

Emerging Market (EM) local currency bonds present a tempting proposition for investors seeking higher yields in a global environment where core market rates remain relatively low. However, beneath the surface of seemingly magnetic carry, lies a complex interplay of local rates, foreign exchange (FX) fluctuations, and inherent political and fiscal risks. Understanding these dynamics is crucial for navigating the EM local bond landscape effectively.

The Allure and Illusion of EM Local Bonds

Nominal yields in various Emerging Markets often stand significantly higher than those in developed economies. For instance, Brazil's yields hover in the low-teens, Russia's in the mid-teens, India's around the mid-6s, and South Africa's approximately 8%. When compared to a US10Y yield of just over 4%, this carry differential can be highly attractive. Yet, EM local bonds are never simply a 'carry' play; they represent a multifaceted investment exposed concurrently to local interest rates, currency movements, and idiosyncratic political and fiscal risks.

The Primacy of Currency Stability

The fundamental question for EM local bond investors is not merely the height of the yield, but the stability of the local currency. High yields can rapidly be eroded or even turned negative if the dollar strengthens markedly or broad risk appetite deteriorates. In such scenarios, foreign exchange depreciation can negate months of accumulated carry in a matter of days. This makes active risk management, especially around significant macroeconomic data releases like the US CPI, paramount.

Furthermore, EM bond curves can remain stressed even when global yields decline. Local supply dynamics, evolving domestic inflation expectations, and the perceived credibility of the central bank often exert a stronger influence on EM local bonds. This means that a seemingly benign global rate environment doesn't automatically translate into positive performance for EM local assets. The best EM local trades are typically relative value strategies or curve trades designed to mitigate significant FX exposure, offering a cleaner risk profile.

Regimes and Catalysts: US CPI as a Market Switch

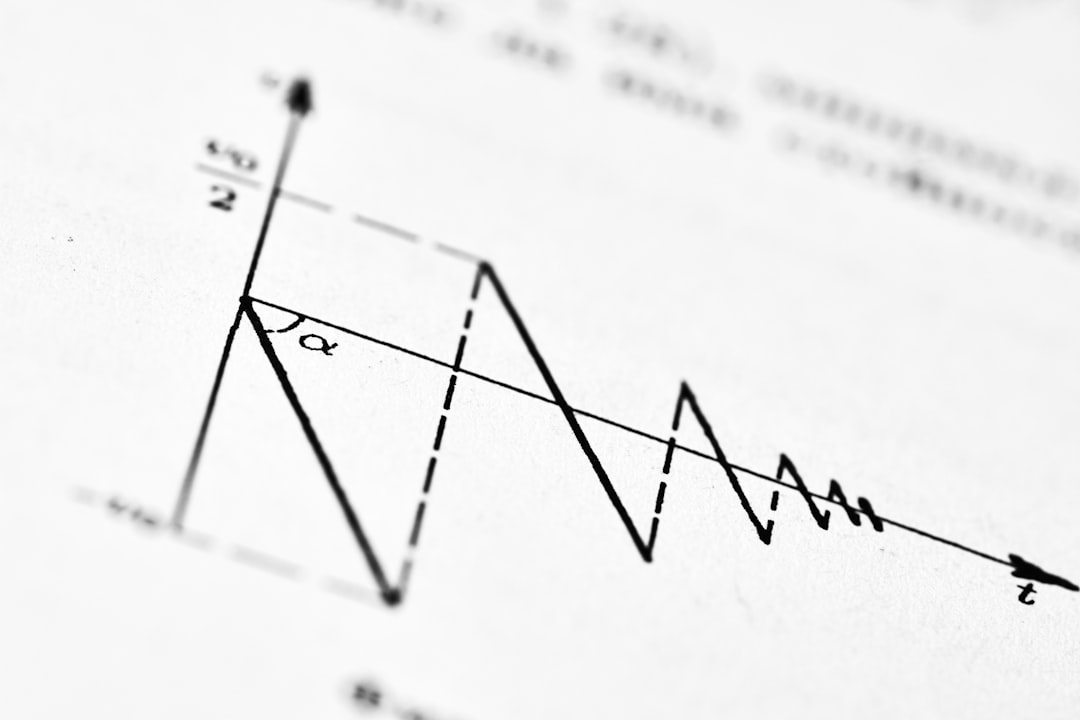

The EM local bond market operates under two distinct regimes:

- Regime 1: Benign Dollar, Stable Volatility: In this environment, carry strategies generally work well, local bond curves behave predictably, and investors can earn returns without excessive drama.

- Regime 2: Strong Dollar or Rising Volatility: Here, FX becomes the dominant trade. Local rates can also cheapen significantly, leading to a double hit on investor returns.

A critical near-term catalyst that can switch the market between these regimes is the U.S. CPI release. A higher-than-expected CPI can lead to a stronger dollar and increased global risk aversion, pushing EM local markets into Regime 2. Other important factors include the broader commodity tape—as oil and metals prices significantly impact many EM terms of trade—and domestic policy surprises such as bond buybacks, switches, or unexpected fiscal announcements. For example, if CPI pushes the dollar higher, we would expect EM local to cheapen in price terms even if local central banks remain steady. This highlights why EM local desks often treat US macro prints like domestic events, closely monitoring their impact on the overarching sentiment.

Practical Risk Control in EM Local Bonds

For those seeking returns, accepting that EM local requires active risk management is essential. If stability is the primary objective, staying within hard currency investment grade bonds and utilising Treasuries as a hedge is advisable. For investors targeting higher returns from EM local bonds, consider these practical risk control measures:

- Define your stop-loss in FX terms, not solely in yield terms, to protect against sudden currency depreciation.

- Avoid concentrated bets on the same commodity theme across multiple EM markets to diversify risk.

- Consider scaling into positions after a volatility spike, rather than before, to potentially capture better entry points.

The opportunity set in EM local bonds is real but highly selective. Countries with robust and credible inflation control mechanisms tend to offer better risk-adjusted carry. Conversely, markets burdened by significant fiscal uncertainty, though offering high nominal yields, often come with unstable drawdowns. If specific tools to hedge currency exposure are unavailable, position sizing should remain modest. The fundamental framework is to first assess whether the dollar is a tailwind or a headwind, then evaluate the trend of domestic inflation, and only then determine if the yield is genuinely attractive. If either of the first two steps signals a negative outlook, a high yield can quickly prove to be a trap.

One simple truth:

In EM local bonds, you earn the carry for taking FX risk, whether you admit it or not. The EM bonds price live and the corresponding EM bonds chart live provide visual indications of this intertwined performance. Investors need continuous access to EM bonds price live data to monitor real-time movements. Evaluating the EM bonds chart live helps in identifying trends and potential inflection points. The EM bonds realtime data is crucial for tactical trading decisions. For long-term portfolio management, understanding the EM bonds live chart context informs strategic allocations. Observing the EM bonds live rate helps confirm trends seen in the charts. The overall EM local bonds price reflects both interest rate differentials and currency valuations. Therefore, the EM local bonds live market requires a comprehensive view of both yield and currency dynamics for informed decisions.

Related Reading

- US CPI: Front-End Trapped, Back-End Negotiating Duration

- Emerging Markets: Carry Trades Demand a Clearer Tape Amid Macro Shifts

- The Dollar's Quiet Pivot: Macro Shifts and Forex Flows Analysis

- China's Bond Market: A Global Shock Absorber Amidst Volatility

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.