Bunds Near Multi-Week Lows, Focus on European Spreads

European bond markets are seeing Bunds near multi-week lows, with investor attention now shifting to the dynamics of European rates spreads rather than outright yields.

European government bonds are currently exhibiting a nuanced picture, with benchmark German Bunds approaching multi-week lows. However, the true narrative lies in the activity across European rates spreads, indicating a market focused on relative value and risk premium adjustments rather than a fundamental shift in the policy path.

Market Snapshot and Intraday Dynamics

At the close of trading, the DE10Y yield stood at 2.7899%, reflecting a slight day-on-day dip, while the FR10Y, IT10Y, and ES10Y also showed minor yield declines. The DXY, a key indicator for dollar direction, registered 96.692. Meanwhile, the VIX, a measure of market volatility, decreased by 2.49% to 17.21, suggesting a period of relative calm in broader markets. WTI crude oil price live was at 64.17, and gold price live was at 5083.67.

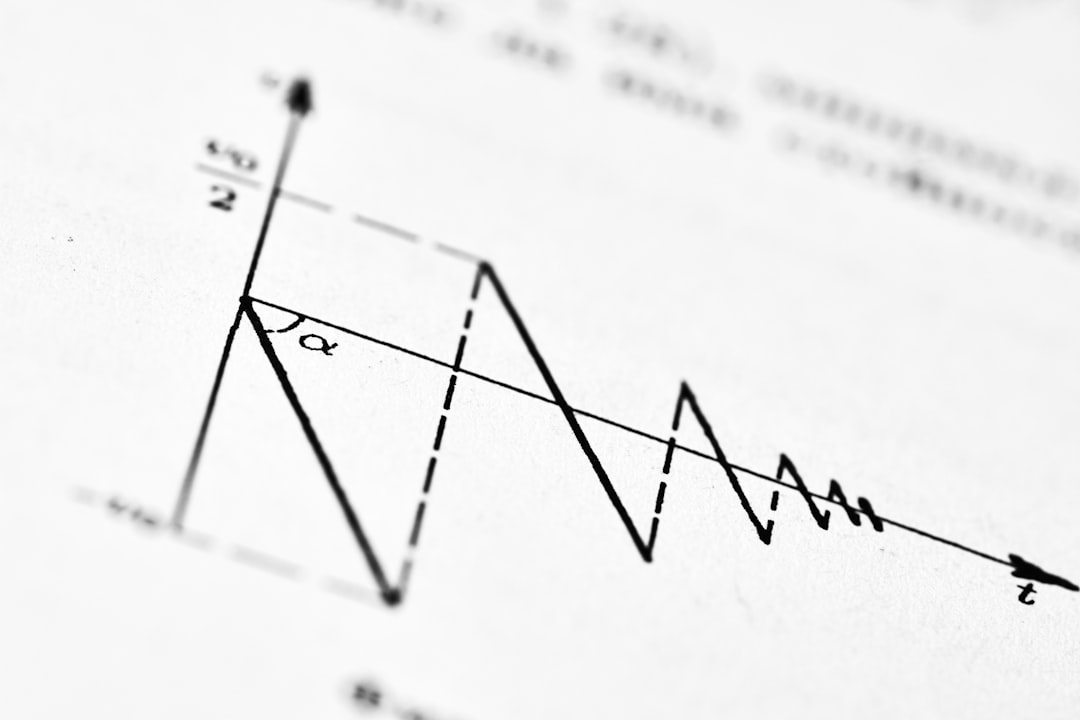

In the current market regime, the most insightful indicators are the shape of the yield curve and the intraday highs and lows across fixed income instruments. When the long end of the curve struggles to sustain a rally even with benign inflation impulses, it frequently signals the influence of supply dynamics and a rising term premium at play. This often means that the market is asking for more compensation to hold longer-dated bonds, regardless of immediate economic news.

Yield Curve and Duration Warehousing

The 2s10s slope remains modestly positive, suggesting that the yield curve is not deeply inverted, a sign often associated with impending recessionary concerns. However, the day-to-day trading is largely dictated by the market's willingness to 'warehouse' duration - essentially, how much long-term interest rate risk investors are prepared to hold. The long end of the yield curve acts as the volatility valve, absorbing much of the price fluctuations and serving as a crucial adjustment mechanism for overall market risk.

Risk Premium and Policy Path

Today's price action appears to be more a reflection of risk premium adjustment than a wholesale reevaluation of the European Central Bank's (ECB) policy trajectory. The clear indication of this is the leadership observed in the long end of the market, where yields are moving more significantly, while the front end of the curve remains relatively anchored. This behavior suggests that investors are pricing in higher uncertainty for the distant future without necessarily altering their expectations for near-term interest rate decisions.

Regime Theory and Trading Strategies

It is crucial for traders to distinguish between market regimes and catalytic events. In a range-bound regime, mean reversion strategies often prove effective, where prices tend to return to their average. Conversely, in a trend regime, clarity on price acceptance and time confirmation is necessary before scaling into positions. For instance, if you are fundamentally long duration due to concerns about growth slowing, it's essential not to confuse this with a 'fiscal protest trade' which would demand different risk management and justification. Understanding these different regimes helps in applying appropriate hedging and sizing strategies.

What to Watch Next (Next 24h)

- Dollar direction: A sustained DXY softness would typically reinforce bids for duration, making long-dated bonds more attractive. Traders should monitor the DXY realtime for further cues.

- Volatility: Does the VIX remain suppressed, or will it re-accelerate, signaling increased market uncertainty?

- JPY moves: Shifts in JPY, particularly as a BOJ/curve tripwire, could have spillover effects on European rates.

- Auction performance: Close attention should be paid to European bond auctions and any indications of concession building, which might impact yields. European spreads are a jump-risk product, meaning they can gap wider or tighter rapidly based on liquidity shifts, making monitoring crucial. Carry compresses these spreads in calm regimes, but unwind dynamics can widen them much faster than models would predict once market liquidity flips, creating significant opportunities and risks.

Deep Dive: European Spreads and Liquidity

The current environment highlights that European spreads represent a 'jump-risk' product. While carry trades typically compress these spreads during calm trading periods, once liquidity dynamics shift, these spreads can widen much more rapidly than quantitative models might forecast. This makes constant vigilance over sentiment and liquidity conditions paramount for those trading in the European fixed income space.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.