Gold as Credibility Hedge: Institutional Trust and Market Insurance

Gold serves as a crucial vote on institutional confidence and a duration alternative when traditional bond hedges begin to falter in 2026.

Gold doesn't necessarily require a recession to spark a rally; instead, it thrives on institutional doubt and the erosion of policy credibility. As we navigate the 2026 macro landscape, the yellow metal has transitioned from a simple speculative vehicle into a sophisticated form of portfolio insurance against geopolitical instability and long-run purchasing power concerns.

Gold as a Duration Alternative

In the current regime, the XAUUSD price live feed is being monitored not just by commodity traders, but by fixed-income managers looking for ballast. In environments where the term premium rises sharply, traditional bonds may lose their effectiveness as a hedge, forcing a rotation into hard assets. Monitoring the XAUUSD chart live reveals how the metal functions as a duration alternative when sovereign credits face scrutiny.

During these shifts, checking the XAUUSD live chart becomes essential to identify if the bid is speculative or structural. Unlike fiat instruments, gold responds to deep-seated credibility stress. This is precisely why we see XAUUSD realtime data holding steady even when real rates suggest otherwise, reflecting a fundamental lack of confidence in traditional fiscal stabilizers.

Cross-Asset Translation and FX Dynamics

A common misconception is that a firm Greenback automatically caps metal gains. However, when the XAUUSD live rate remains resilient alongside a strong Dollar, it signals that demand is driven by insurance motives rather than simple currency play. Investors often search for a gold live chart to see if the metal can decouple from its typical inverse relationship with the USD.

For those tracking the gold price for execution, the divergence between paper markets and physical demand is telling. If the gold chart shows higher lows during risk-on sessions, it suggests that institutional buyers are quietly accumulating a hedge against future credit spread widening. This structural bid makes the gold live performance a leading indicator for upcoming market dispersion.

Technical Levels and Regime Signals

To understand the current regime, one must look past the daily noise and focus on whether the asset holds gains during periods of equity strength. If the market continues to pay a premium for this insurance, it confirms that the underlying regime is one of institutional transition. For deeper technical context, traders should reference our analysis on US Treasury Yields and the Gold Unwind to see how the bond's second derivative is impacting price action.

Related Reading

- US Treasury Yields and the Gold Unwind: The Bond Second Derivative

- The Term Premium Tax: Decoding Why Markets Feel Tighter in 2026

- Gold Price Analysis: Range Trade with Asymmetric Break Risks

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

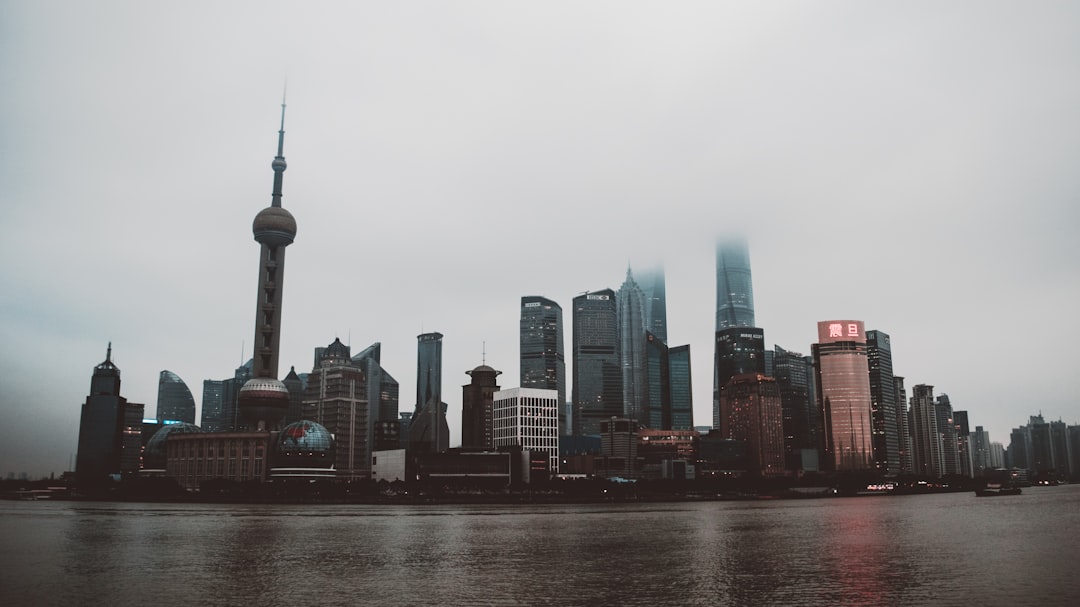

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.