China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.

The traditional "China trade"—a binary switch toggled by the presence or absence of stimulus headlines—is increasingly failing to capture market realities in 2026. Instead, China has evolved into a two-speed system where strategic manufacturing and electrification thrive independently of the lingering instability in the property sector.

The Divergence: Manufacturing vs. Property

For years, market participants traded China as a monolith. However, current data suggests that demand is now vector-based rather than general. We are seeing a distinct separation where industrial upgrading, EV supply chains, and power grid infrastructure receive structural policy support. Conversely, legacy construction and property-linked activity remain volatile and largely unimproved by broader macro interventions.

Understanding this "two-speed reality" is essential for reading global demand signals. Inputs tied to the technology frontier often see persistent demand even when headline GDP figures look soft. Those holding a generic basket of China-facing assets often find themselves "chopped" by the lack of correlation between these two distinct economic engines.

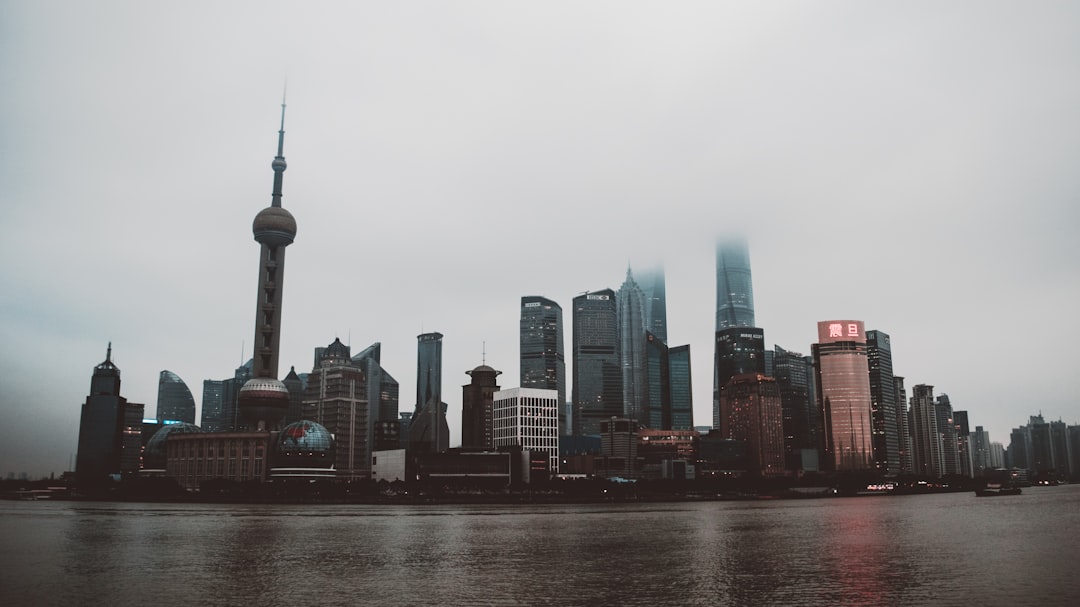

When analyzing these shifts, tools like the Shanghai Composite Index strategy can provide insight into how local sentiment is absorbing this structural transition. Furthermore, the China January PMIs slip into contraction highlights the friction between falling legacy demand and the rising strategic sector.

Cross-Asset Implications in 2026

The practical result of this bifurcation is felt most acutely across the commodity and FX landscapes:

- Commodities: Electrification metals (such as copper and lithium) remain structurally supported. Meanwhile, bulks like iron ore, which are tied to construction, remain heavily sentiment-driven and prone to whipsaws.

- FX Dynamics: Commodity currencies, such as the AUD and NZD, now respond to the dominant demand vector rather than the loudest stimulus headline. Watching the USD/CNH realtime levels is crucial for gauging how the offshore yuan reflects the capital flows associated with these strategic sectors.

- Equities: We are seeing massive dispersion across sectors. The market is rewarding exposure to energy security and punishing legacy excess.

As the copper and the AI grid analysis suggests, the infrastructure truth serum is found in specific industrial metals rather than broad-based indices. Traders monitoring the USD CNH price or USD CNH realtime data will notice that the USDCNH price live action often reflects this underlying industrial health better than property market reports.

Strategic Position and Trade Execution

The USD CNH live chart remains a primary barometer for global risk appetite regarding China. When observing the USD CNH chart live, players should look for stability in the USD to CNH live rate as a sign of policy acceptance of the current manufacturing pivot.

For those executing trades, the USD CNH price and the USDC/NH price live data feeds should be used to confirm if the CNH dollar live is reacting to manufacturing strength or property weakness. Monitoring the USD CNH realtime feed alongside import composition and inventory behavior will be the key to avoiding the "China trap."

Conclusion: What is China Building?

The definitive question for 2026 is no longer "Is China up or down?" but rather "What is China building?" The global market is currently repricing to account for a nation that values energy security and industrial upgrading over broad property reflation. By focusing on sector-specific demand and the USD CNH chart live technicals, traders can better navigate this two-speed economy.

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

Oil's Risk Premium: Energy as a Global Macro Constraint

Oil is evolving from a simple inflation input into a structural macro constraint, forcing a repricing of global risk premia and central bank policy expectations.