Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

In the current 2026 macro landscape, markets remain obsessed with the absolute level of interest rates. However, the more pressing issue for traders is not the level itself, but the increasing variance of rates. When the path becomes unstable, positioning is frequently punished on both sides as stops, hedges, and leverage—originally calibrated for a smoother macro tape—suddenly fail.

The Breakdown of Traditional Hedging

High rates, while restrictive, remain an environment that can be systematically hedged. High variance, conversely, is a hedge-breaker. In this regime, we see correlations flip and liquidity thin as intraday ranges expand beyond historical norms. The result is a market that trades more like a chain of forced rebalances than a clean discounting machine. This explains why a single session can deliver a risk-off open, a massive squeeze higher, and a late reversal. In many cases, the market hasn't changed its fundamental view; it has simply purged fragile exposure before the EURUSD price live feed settles back into a reset position.

Cross-Asset Impact: FX and Commodities

In the foreign exchange markets, liquidity is the ultimate winner. Strategy must account for the fact that carry trades are increasingly difficult to hold because variance turns minor fluctuations into premature stop-outs. This is particularly evident when monitoring the EUR/USD price live or when investors check the EUR USD live chart for signs of trend exhaustion. Whether you are watching the EUR USD price for tactical entries or the EUR USD chart live for structural shifts, the volatility profile currently outweighs the yield differential.

Commodities also face a dual-edged sword. While hard assets often serve as a hedge against credibility stress, they are not immune to sudden liquidity drains. Traders watching the EUR to USD live rate often see immediate spillover into gold or oil during these variance spikes. Real-time data, such as EUR USD realtime movements, suggests that the euro dollar live relationship is currently the primary transmitter of this volatility across the commodity complex. Using a EUR USD price live feed is no longer just about the pair itself, but about gauging global liquidity health.

Strategic Response: Prediction vs. Structure

For the disciplined investor, the response to this high-variance environment must shift from prediction to structure. This involves smaller position sizing and clear, non-negotiable invalidation levels. In high-variance regimes, the first break of a level often serves merely to test liquidity, while the second or third break is what truly defines the nascent trend. Keeping a EURUSD price live ticker active is essential, but interpreting the EUR USD live chart through the lens of volatility term structure provides the necessary edge.

Related Reading

- Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

- The Correlation Trap: Why Diversification Fails in 2026

- The Term Premium Tax: Decoding Why Markets Feel Tighter in 2026

Frequently Asked Questions

Related Analysis

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

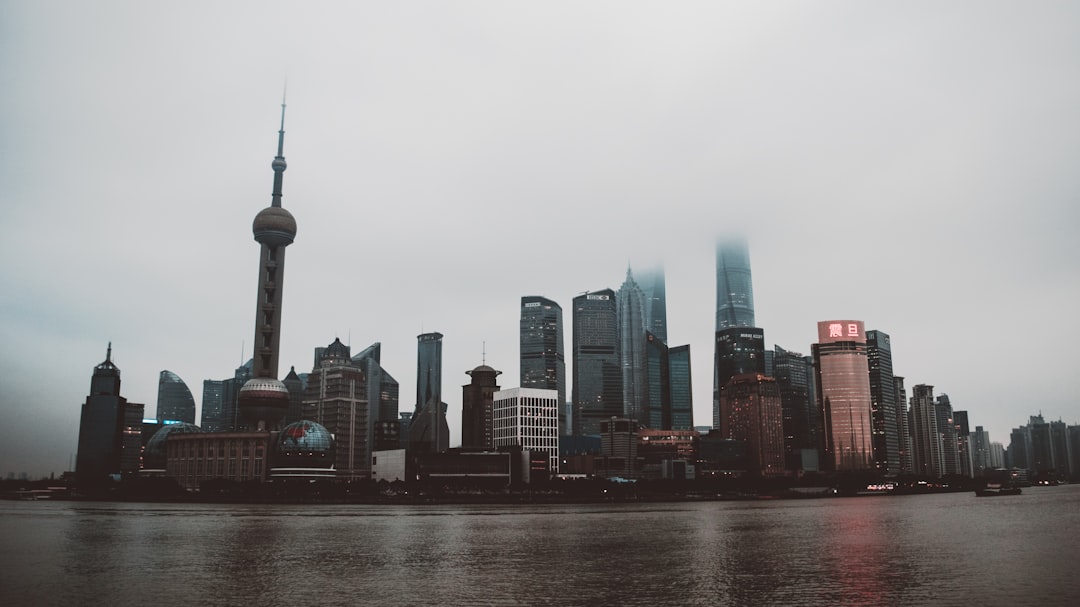

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.

Oil's Risk Premium: Energy as a Global Macro Constraint

Oil is evolving from a simple inflation input into a structural macro constraint, forcing a repricing of global risk premia and central bank policy expectations.