Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

In the current market regime, politics has graduated from being mere background noise to becoming a primary macro factor. The clearest indicator of this shift is when risk premia begin to ascend even in the absence of deteriorating economic data.

Pricing the Unknown: The Uncertainty Tax

We are witnessing a environment where the market is no longer just pricing outcomes; it is pricing uncertainty itself. In such a regime, a full-scale recession isn't a prerequisite for credit spreads to widen or equity multiples to compress. Instead, an unstable policy path acts as the primary catalyst. When the future trajectory is unclear, investors naturally seek optionality, leading to increased cash holdings, demands for higher compensation, and a tactical shortening of duration exposure. In this context, liquidity becomes a premium good that dictates the EUR USD live chart trends and broader market sentiment.

Policy uncertainty often transmits across the global economy far faster than actual economic weakness. We see this through stalled corporate capex and a marginal slowdown in hiring as firms adopt a "wait and see" approach. This collective hesitation widens the probability distribution around global growth, affecting everything from sovereign debt to the EUR USD realtime pricing seen in high-frequency trading.

Cross-Asset Transmission Channels

The transmission of policy risk across assets is rarely linear. In the FX markets, uncertainty typically bolsters the Greenback as a global risk-off refuge. However, this dynamic shifts if the uncertainty becomes domestically focused, potentially causing the EUR to USD live rate to decouple from traditional interest rate differentials. Monitoring the EUR USD chart live becomes essential to identify where refuge flows are concentrating.

Within fixed income, we are seeing the emergence of a "credibility tax." The term premium can rise even while growth expectations soften, a phenomenon often discussed in our analysis of The Term Premium Tax. This tightening occurs because investors demand a higher yield for holding long-dated paper in an unpredictable legislative environment.

Strategic Positioning and the Credibility Hedge

For equity investors, long-duration growth stocks are usually the first to reprice downward during policy spikes, while defensive sectors regain relative strength. Meanwhile, instruments like euro dollar live pairs and gold serve as mirrors for institutional trust. As noted in our research on Gold as a Credibility Hedge, real assets can significantly outperform when fiat-based policy paths are called into question.

The core tradable insight for February 2026 is to separate isolated headlines from the broader volatility regime. High uncertainty equates to higher dispersion and less reliable correlations. Rather than trading the next political headline, traders should look at the EUR USD price live and the EUR/USD price live through the lens of survival: owning exposures that do not require perfect timing or absolute policy clarity. Keeping a close eye on the EUR USD price and the EURUSD price live will remain critical as these pairs act as the primary valve for global macro tension.

What to Watch Next

As we move deeper into the quarter, investors should scrutinize corporate guidance for changes in capex language and look for new issue concessions in the credit markets. Furthermore, monitor whether volatility is spilling into "carry-like" pairs that historically remained stable, as this often signals a breakdown in the EUR USD live chart correlations that typically anchor the market.

Related Reading

- The Term Premium Tax: Decoding Why Markets Feel Tighter in 2026

- Gold as Credibility Hedge: Institutional Trust and Market Insurance

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

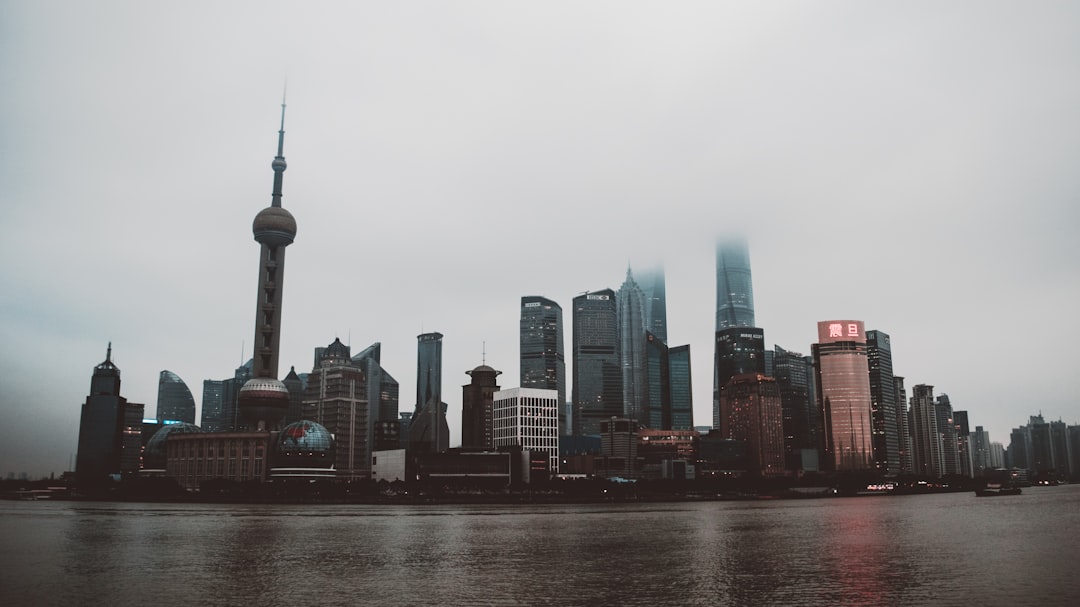

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.

Oil's Risk Premium: Energy as a Global Macro Constraint

Oil is evolving from a simple inflation input into a structural macro constraint, forcing a repricing of global risk premia and central bank policy expectations.