The Power Bottleneck: Why Utilities Suddenly Matter to Tech Investors

In 2026, the tech boom faces a physical limit: power generation. Explore why utilities have transformed from defensive plays into essential strategic enablers.

Every market cycle eventually encounters a hidden bottleneck; in the current landscape of 2026, that bottleneck is the physical infrastructure of power. As data centers scale at a pace that far outstrips generation and grid upgrades, electricity has evolved from a simple operational cost into a critical strategic constraint.

The Shift from Defensive to Strategic Enabler

Historically, the utilities sector was the hallmark of a slow, "dull" investment strategy characterized by low volatility and steady dividends. However, in a power-constrained regime, utilities and grid suppliers have become the mandatory enabling layer for the highest-growth segments of the global economy. The market is no longer pricing these firms as mere defensive proxies; instead, it is assigning a premium based on duration-like stability coupled with strategic scarcity.

For those monitoring broader market movements, the DXY price live feed remains a vital tool, as the strength of the dollar continues to influence the cost of global infrastructure investment. Furthermore, as liquidity flows into these capital-intensive projects, keeping an eye on the US10Y realtime yield is essential for understanding the cost of debt for utility buildouts.

Cross-Asset Implications for 2026

The rotation into industrial electrical infrastructure has significant consequences across various asset classes. In the equity space, "enablers"—those involved in transmission, transformers, and grid services—have moved from the periphery to the essential core of growth portfolios. We are seeing a fundamental repricing where the XAUUSD live rate may fluctuate as investors balance traditional hedges against the tangible physical assets of the power grid.

In the commodities sector, the XCUUSD chart live (Copper) and Aluminum prices are benefiting directly from the accelerating grid replacement cycles. These metals are the literal nervous system of the new economy, and their copper price serves as a direct proxy for the pace of global electrification. For a broader view of how these trends impact major indices, traders often look at the US500 live chart to see how the rotation from pure tech to power-utilities influences the S&P 500's performance.

Key Variables to Watch

As we move through the first quarter of 2026, success in this environment requires monitoring specific execution variables. Financing conditions have become a primary hurdle; thus, checking the US10Y live rate frequently helps analysts determine if infrastructure projects remain viable. Simultaneously, energy costs are keeping inflation expectations higher for longer, a trend reflected in the DXY realtime trends as policy remains conditional on these input costs.

The core of this market story is that the next technology boom is currently gated by the oldest problem in capitalism: access to cheap, reliable power. Investors who ignore this physical constraint risk being caught on the wrong side of a major sector rotation. As you analyze individual tickers, remember that XAUUSD price live movements often signal broader shifts in risk appetite that can precede utility volatility.

Future Outlook and Triggers

To stay ahead of the curve, keep a close watch on grid congestion metrics, permitting speed, and corporate earnings calls. When power availability is cited as a reason for delayed expansion, it becomes directly earnings-relevant. Monitoring the DXY chart live can also provide clues on how international capital is being allocated toward these global energy solutions.

Ultimately, whether you are following the gold live chart or the US10Y chart live, the narrative is the same: the grid is the new frontier of growth. Those who master the gold price and commodities link will better understand the inflationary pressures that make utilities such a compelling hedge in 2026.

Related Reading

- Private Credit Volatility 2026: Identifying Early Stress Signals

- Shipping as the Hidden Inflation Input: The Physical Economy Channel

- Bond Market Strategy: Navigating the 4.24% US 10Y Yield Pivot

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

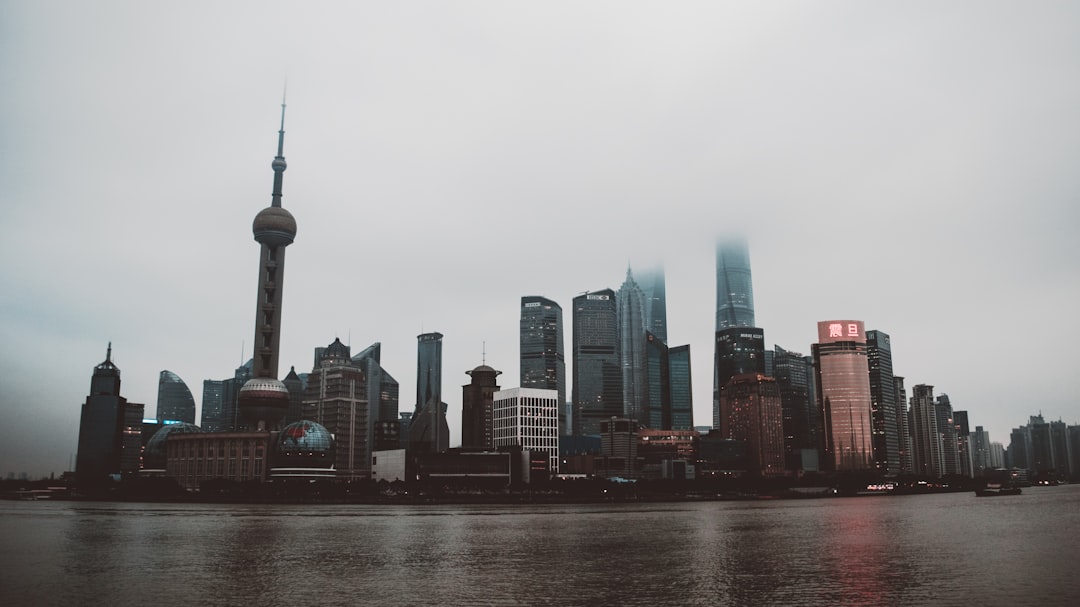

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.