Silver 2026: The Solar Bottleneck Trade and Industrial Demand

Silver is emerging as a critical industrial infrastructure asset for 2026, driven by a structural bottleneck in solar PV manufacturing and a tightening supply chain.

Silver is no longer merely the "poor man’s gold"; in 2026, it has transformed into a critical infrastructure asset. As the market wakes up to a structural supply-demand mismatch, the white metal is increasingly being priced as a supply-constrained industrial input that remains prone to explosive monetary bids.

The Solar Narrative: Why 2026 is Different

Solar energy has transitioned from a niche green energy play into foundational global infrastructure. This shift is critical for silver because infrastructure demand is policy-supported and capex-driven, making it resilient even during temporary macroeconomic slowdowns.

The Physics of Photovoltaic Demand

Silver remains the gold standard for conductivity in photovoltaic (PV) electrical contacts. While the industry attempts to "thrift"—using less silver per panel—two physical realities maintain a floor under demand:

- Global Scale: Even as silver-per-panel decreases, the sheer volume of global installations continues to rise, leading to higher total silver consumption.

- Durability Constraints: At industrial scales, there is a limit to how much conductivity can be sacrificed before panel reliability and efficiency are compromised.

The Supply-Side Constraint: A Byproduct Problem

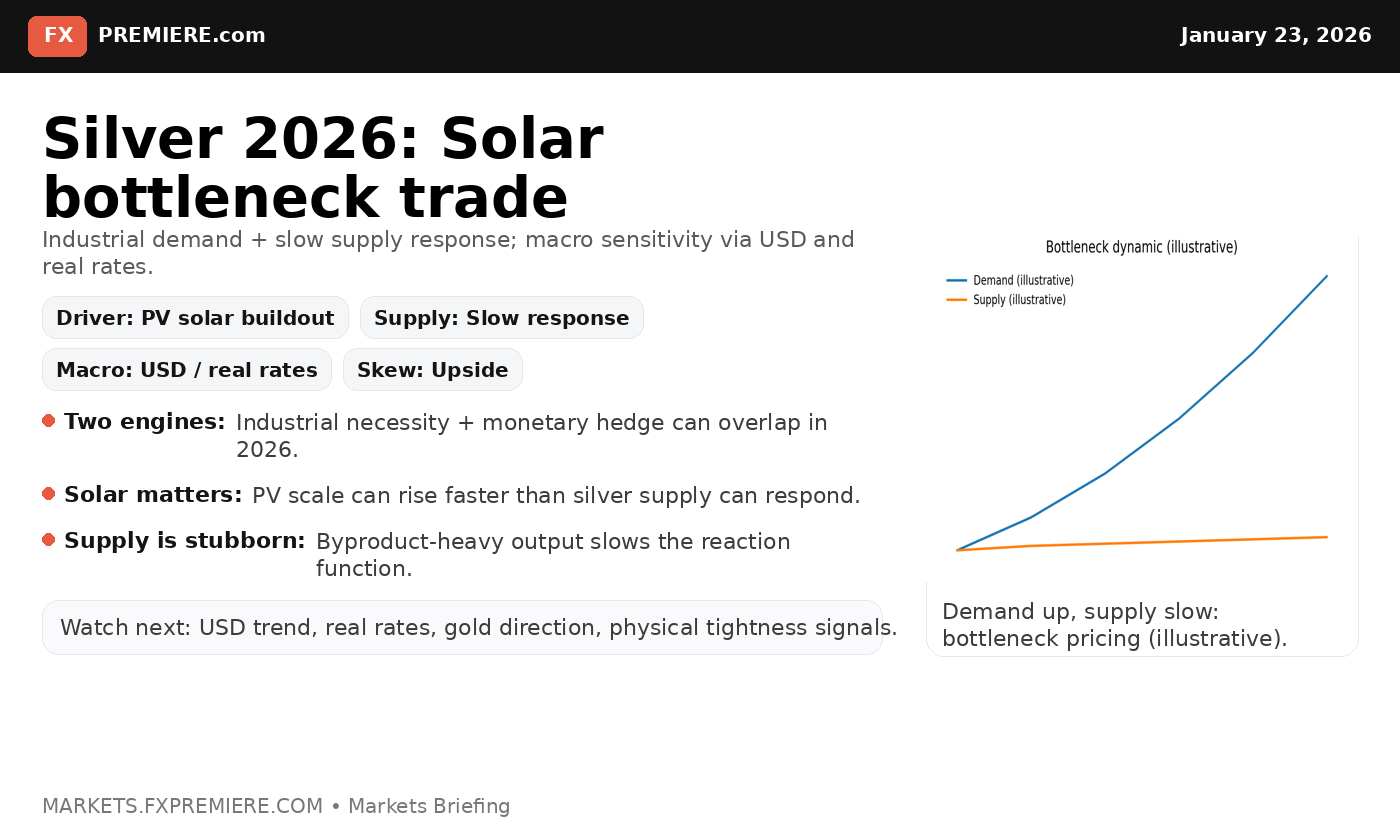

A significant portion of global silver production is a byproduct of lead, zinc, and copper mining. This creates a unique structural lag. Unlike primary silver mines, byproduct supply does not respond immediately to higher silver prices. Instead, tightness often manifests as rapid inventory depletion and sudden, aggressive repricing rather than a steady upward trend.

Cross-Asset Transmission and Market Volatility

Silver exists at a unique intersection of two market regimes. On one side, it is an industrial metal tied to manufacturing and electrification. On the other, it is a monetary hedge sensitive to real rates, the USD, and geopolitical credibility. When these two engines overlap—industrial tightness meeting a monetary bid—silver historically moves like a high-beta version of gold.

Key Risks to the 2026 Bull Case

While the structural floor appears higher, investors must monitor two primary risks:

- Real-Rate Shocks: A sharp rise in real yields coupled with a tightening USD can force silver into a tactical sell-off, treating it as a risk-off asset despite industrial demand.

- Manufacturing Air Pockets: A global growth downturn could temporarily dominate the tape, leading to short-term liquidations.

Strategic Outlook: What to Watch

Heading into the remainder of 2026, market participants should focus on solar installation momentum and physical tightness signals. As the world builds an electricity-heavy future, silver sits at the core of the transition. Recently, we have seen similar dynamics in related commodities, as detailed in our analysis of Silver Laps Global Markets: Analyzing the 155% Annual Surge.

Furthermore, the interplay between insurance demand and real yields remains a primary driver for the precious metals complex. For deeper context on how these macro drivers affect the broader sector, see our Gold Price Analysis: Insurance Demand vs Real Yield Drivers.

Frequently Asked Questions

Related Stories

Macro Brief: Inflation, Treasury Refunding, & Market Dynamics

Today's market brief analyzes how Eurozone inflation, Treasury refunding, and OPEC+ decisions are shaping global cross-asset dynamics, alongside key shifts in AI funding and cryptocurrency volatility.

The Cost of Resilience: How Reshoring Reshapes Global Markets

New supply chain policies like reshoring and stockpiling are shifting economic cost curves and impacting critical minerals, commodities, and manufacturing credit. This deep dive explores how these...

Sector Rotation: Why Quality Cyclicals Trump Duration Now

In a shifting market landscape defined by sticky rates and geopolitical turbulence, sector rotation strategies are emphasizing balance-sheet strength and policy visibility over duration-sensitive...

Crypto Markets: Navigating Policy, Liquidity, and Valuation Reset

Bitcoin (BTC) and Ether (ETH) volatility remains high amidst unresolved U.S. stablecoin policy talks, keeping regulatory risk premium in digital assets tethered to macro liquidity and policy...