Silver Laps Global Markets: Analyzing the 155% Annual Surge

Silver has outperformed every major asset class in 2026, gaining 155.8% as industrial demand and monetary hedges collide in a massive supply squeeze.

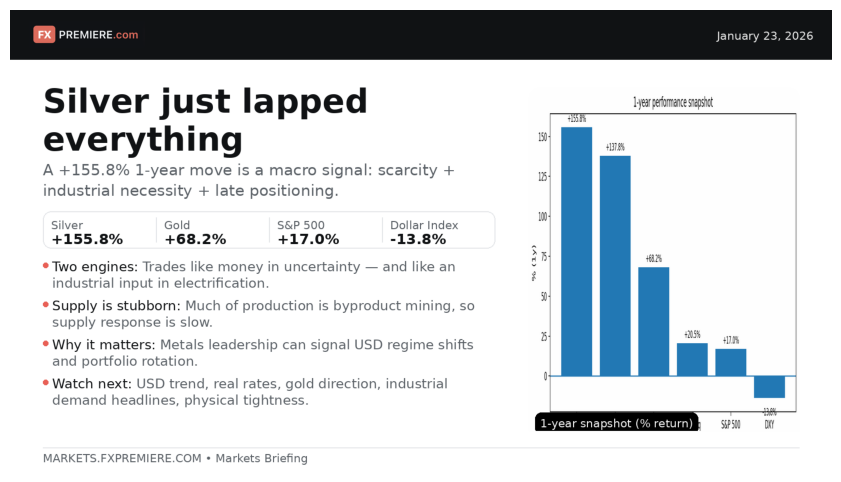

A dramatic one-year performance snapshot has delivered a blunt reality check to global investors: Silver has officially lapped every major asset class, posting a staggering 155.8% gain while tradiitonal equity benchmarks and energy contracts lag behind. This isn't just a volatility spike; it is a fundamental repricing of physical scarcity over market narratives.

The Great Commodity Divergence: Silver vs. The World

As of late January 2026, the leaderboard for annual returns reveals a massive rotation into hard assets. While Silver leads at +155.8%, Platinum (+137.8%) and Gold (+68.2%) follow closely, dwarfing the performance of the Nasdaq (+20.5%) and the S&P 500 (+17.0%). Conversely, the traditional cyclical engines are sputtering; the Dollar Index is down 13.8%, while WTI Crude Oil has slumped over 22%.

Silver has spent years as the "forgotten cousin" of the metals complex—deemed too volatile to own and too awkward to explain. This period of being under-owned and ignored is exactly why the current move has become unstoppable. The market is finally waking up to the fact that silver is not a single trade, but two distinct macro forces stacked on top of each other.

1. The Hard Money Hedge

When policy credibility is questioned and geopolitics becomes a daily risk input, investors reach for hard collateral. While Gold serves as the primary insurance bid, Silver acts as the high-beta follow-through. It trades like money when confidence in fiat regimes begins to shake.

2. The Industrial Backbone of Electrification

Unlike jewelry-focused metals, silver is a critical industrial input. As the best electrical conductor on Earth, it is embedded in the infrastructure of modern life. From solar panels and data centers to EV power grids and high-reliability connectors, silver demand has moved from optional to foundational.

The Supply Squeeze: Why This Move Can Extend

Most commodity bulls focus exclusively on demand, but the real edge lies in understanding the supply response. Silver supply is notoriously stubborn because a significant portion of production is a byproduct of lead, zinc, and copper mining. Production cannot simply be "turned on" because prices scream higher.

When demand tightens and physical inventories are drawn down, the market’s only mechanism to balance the books is price. High prices must ration demand and force short-side repositioning, often resulting in the outsized squeezes we are seeing now. This relates back to the convex macro hedge dynamics we previously identified as a key trend for 2026.

Cross-Asset Implications: Beyond the Metal

Silver's dominance is a bellwether for broader market shifts:

- FX Dynamics: A falling USD regime makes silver a natural beneficiary. When the DXY drops while metals surge, it confirms a structural macro shift rather than temporary noise.

- Equities vs. Real Assets: The magnitude of outperformance reminds us that real assets can dominate portfolios even during modest equity grinds.

- Energy Disconnect: With Crude Oil down and Silver up, the market is signaling that energy is cyclical, while metals have become structural.

- Crypto Comparison: Silver outperforming a relatively flat Bitcoin undercuts the "digital-only" scarcity narrative, proving that physical collateral still carries a heavy weight in unstable regimes.

Silver doesn't move like this because the market is early; it moves like this because the market is late to structural industrial demand and a rising premium on hard collateral.

Investor Checklist: Tracking the Momentum

To determine if this rally has more runway, traders should monitor:

- The US Dollar trend (DXY) as a primary tailwind facilitator.

- Real rates and the "opportunity cost" of holding non-yield assets.

- Gold's trend, as it often acts as a leading indicator for silver amplification.

- Headlines regarding solar and data center buildouts.

- Physical delivery stress and exchange inventory drawdowns.

Related Reading:

- Gold Price Analysis: Insurance Demand vs Real Yield Drivers

- Silver Convexity: Trading High Beta Range Dynamics in 2026

- WTI Crude Analysis: Why Spot Price Needs Balance-Sheet Validation

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.