Bonds: Unloved But Essential for Portfolio Resilience

Despite recent negative sentiment, bonds remain a crucial component of a well-diversified portfolio. This analysis explains why their current positioning, improved expected returns, and hedging...

In recent years, bonds have cycled through phases of being declared 'dead,' 'uninvestable,' or 'too risky,' yet they persistently re-enter market discussions. This cyclical pattern of sentiment is precisely why bonds, particularly in their current state, warrant renewed attention from investors. When an asset class faces universal dislike, it often signals light positioning, improved expected returns due to higher yields, and a potential resurgence of their hedging power during market shocks.

The Enduring Relevance of Bonds in 2026

The common mistake is to view bonds as a monolithic asset class. In reality, the bond market is nuanced, with different segments serving distinct purposes. Understanding that duration, inflation risk, and term premium all factor into the equation is crucial. Therefore, the pertinent question isn't whether bonds 'work,' but rather, 'which bonds work for which specific shock?'. This discerning approach allows investors to leverage the specific characteristics of different bond types for optimal portfolio construction.

Targeting Specific Market Regimes with Fixed Income

Our analysis suggests a targeted approach to fixed income. For instance, in scenarios marked by equity drawdowns stemming from growth fears, core duration bonds continue to offer a reliable hedge. It's important to remember that a perfect hedge isn't always necessary; a consistently reliable one is often sufficient to mitigate risks. Furthermore, when countering inflation shocks, Treasury Inflation-Protected Securities (TIPS) provide a more direct and effective hedge compared to nominal bonds, though their liquidity can be a factor during extreme market conditions. An example of this market sentiment can be seen with TIPS vs Nominals: Decoding Inflation Pricing & Policy Impact, where inflation pricing strategies are discussed.

Conversely, for fiscal or term premium shocks, the long end of the yield curve often represents the danger zone. The noteworthy strength observed in recent long-end auction demand indicates underlying real money support at current yield levels. This implies that while the long bond market can be volatile, there's still a segment of the market that sees value, making China's Bond Market: A Global Shock Absorber Amidst Volatility an interesting case study for understanding duration dynamics.

Key Portfolio Takeaways and Implementation Strategies

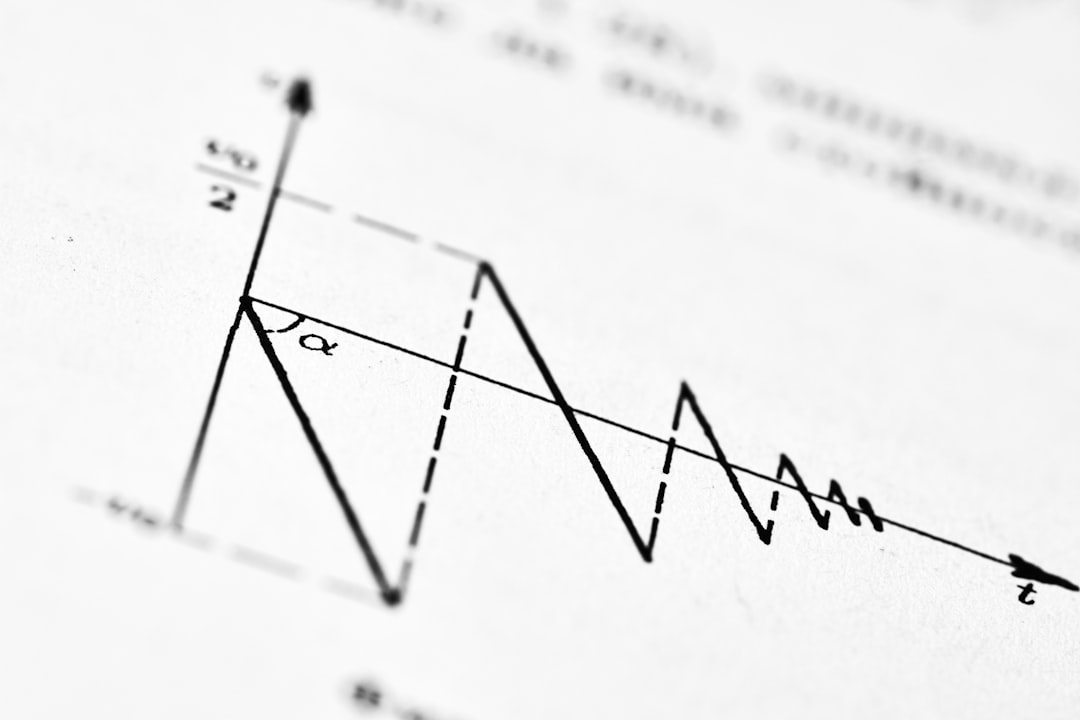

For investors holding risk assets, incorporating some duration in their portfolio acts as a rational form of insurance. If inflation concerns loom, a pragmatic approach involves pairing nominal bonds with inflation protection instruments rather than abandoning fixed income entirely. Moreover, those apprehensive about term premium should consider keeping their duration exposure concentrated in the 'belly' of the curve (e.g., 2Y and 5Y behave like policy instruments), avoiding over-concentration in the ultra-long end unless explicitly seeking such exposure. This is why the yield on Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind is so closely watched by analysts.

From a multi-asset management perspective, bonds should be treated as a versatile toolkit. Belly Treasuries are ideal for growth-risk hedging, while TIPS serve as an effective means of inflation-risk hedging. Core European bonds can provide valuable regional diversification, offering a contrast to the domestic bond market. The advantage of current higher yields extends beyond mere income generation; this income can offset a portion of the mark-to-market volatility, thereby enhancing the durability of the hedge.

Consider the critical question: if equities were to drop 10% next month, would you prefer owning an asset 'likely to rally' or one that 'might rally but could also sell off due to rising term premium'? The answer hinges on understanding the nuances of the bond market and selecting the segment that aligns with your specific risk profile. With 10Y TIPS 1.79%, investors are clearly looking for inflation protection. The Gold 4972 is another indicator that investors are looking for safe havens.

The Resurgence of Meaningful Bond Returns

With yields significantly higher than those observed in the preceding decade, bond returns are no longer solely reliant on price appreciation. The 'carry' – the income generated from holding bonds – has become meaningful once again, diminishing the 'all or nothing' sentiment prevalent when yields were near zero. However, this renewed significance also underscores the importance of differentiation within the bond market.

Specifically, the 2Y and 5Y segments behave predominantly as policy instruments, reflecting central bank rate expectations. The 10Y segment, often highlighted in discussions about the US duration, acts as a barometer for broader macro trends and term premium. The 10Y 4.109% is a live example of this. Lastly, the 30Y segment, currently at 4.74%, functions as a gauge of fiscal health and convexity. For investors seeking to effectively hedge their portfolios, choosing the bond segment that precisely matches their risk concern is paramount.

Related Reading

- TIPS vs Nominals: Decoding Inflation Pricing & Policy Impact

- China's Bond Market: A Global Shock Absorber Amidst Volatility

- Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.