Fed Independence Risk Premium: The Quiet Bid Under Long Bonds

Amidst bond market dynamics, a quiet bid under long bonds suggests a 'Fed Independence Risk Premium' is at play, influencing prices more than a fundamental rewrite of the policy path.

The bond market is currently exhibiting fascinating dynamics, particularly concerning the long end of the curve. Far from being driven solely by policy expectations, a 'Fed Independence Risk Premium' seems to be providing a quiet, yet significant, bid under long bonds, suggesting that current movements are more about risk premium adjustments than a complete overhaul of the policy trajectory.

Understanding Current Bond Market Dynamics

Analyzing the bond market requires discerning between different drivers. For instance, the Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind, which is evident in today's price movements. When the long end struggles to maintain a rally, even with benign inflation signals, it frequently points to supply dynamics and term premium at play. This isn't necessarily a radical shift in the anticipated policy path, but rather an adjustment in how that path is priced into longer-dated securities. We focus on the Bunds & Treasuries: Safe Haven Status Amid Fiscal Slippage as part of our analysis.

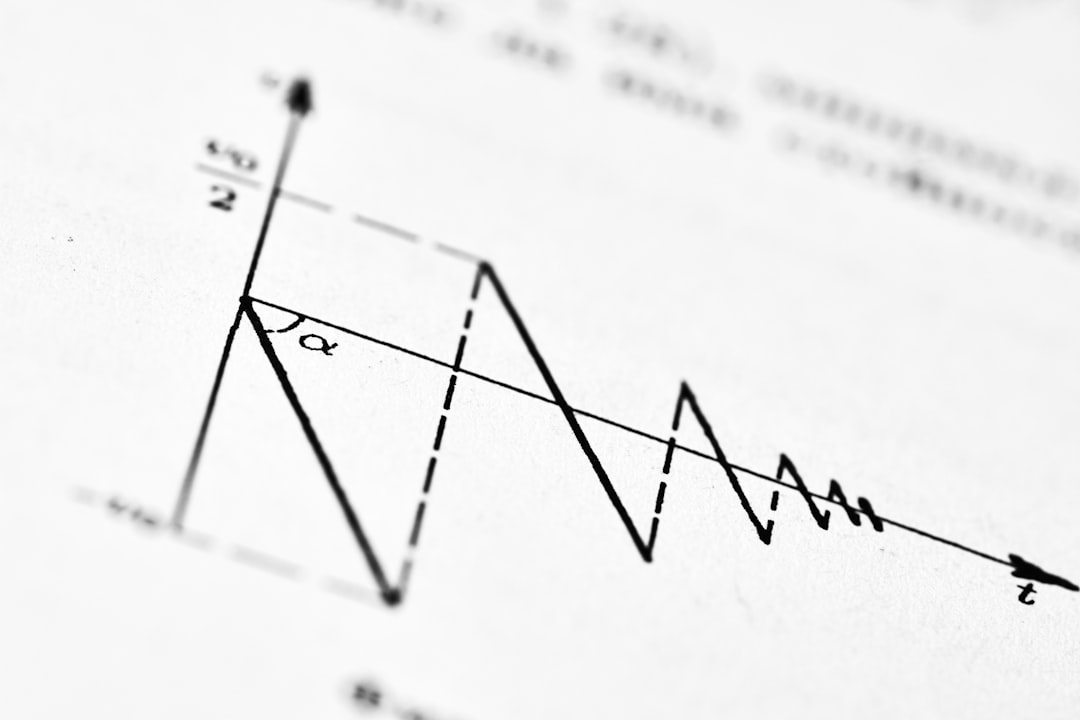

To break this down, consider the market in three distinct segments: policy-driven effects (typically seen in 2-year bonds), macro balance considerations (influencing 5-year to 10-year bonds), and term premium (most prominent in 20-year to 30-year bonds). The current activity, reflected by a US30Y price live, strong at 4.788%, clearly indicates a term premium unwind as the primary factor, rather than a fundamental change in the Fed's future actions. The US10Y price live is also closely watched for these shifts. Similarly, for those tracking broader markets, the Gold live price and WTI price live are complementary indicators.

Key Observations and Trading Regimes

The latest price action, with the long end showing leadership while the front end remains relatively anchored, suggests a risk premium adjustment. This means investors are re-evaluating the compensation they demand for holding longer-duration assets, partly due to the implied Bond Term Premium Returns: Supply Drives Yield Dynamics. A US10Y realtime look confirms this observation. This phenomenon is distinct from a wholesale recalibration of the monetary policy trajectory, which would see more synchronized moves across the curve. The US30Y实时 rate is consistently reflecting this reality.

Understanding the difference between a range regime and a trend regime is crucial for traders. In a range-bound market, mean reversion strategies often succeed, whereas in a trend-driven market, confirmation and acceptance of new price levels are necessary before scaling up positions. For instance, the DXY price live is showing a slight decrease, influencing various other instruments. The US10Y to 30Y live rate provides crucial insights into the market's current perspective.

The wisest approach in trading is to operate within established ranges. The most perilous moments often occur during the first 30 minutes after an unexpected data release, when liquidity is thin and reaction volatile. Monitoring the US30Y price offers some stability benchmarks. Even when considering global markets, such as the Bunds near multi-week lows, European spreads, or the Yen bond market, the overarching principle remains: the quiet bid under long bonds reflects deep structural forces beyond mere daily headlines. Therefore, a US10Y to US30Y live rate is an important metric for serious bond traders.

What to Watch Next

- Curve Shape: Pay close attention to whether the yield curve is steepening or flattening. This provides an immediate 'tell' about the prevailing market regime and whether the Fed Independence Risk Premium continues to exert influence.

- Spread Behavior in Europe: European bond spreads serve as an excellent barometer for wider carry-risk sentiment. Traders should evaluate the European bond dynamics including the OATs Quiet: Term Premium Unwind Drives European Bond Dynamics.

- JPY Moves: Any significant shifts in the JPY could act as a tripwire, signaling potential interventions or changes in the Bank of Japan's yield curve control policy. The US30Y chart live consistently visualizes these trends.

- Volatility: Observe whether the VIX remains suppressed or begins to re-accelerate. A prolonged suppressed VIX could reinforce the idea of a stable risk premium, whereas an acceleration might signal renewed market anxiety. The US10Y chart live also provides visual confirmation of these trends.

The US10Y bond futures live are continuously updating, emphasizing the minute-by-minute evaluation required in this market. This period highlights that the quiet bid under long bonds is less about immediate headlines and more about deeper structural adjustments, particularly related to the perceived independence and long-term credibility of central bank policy.

Snapshot of Key Market Instruments

- US10Y: 4.161% (day 4.145%–4.195%), -0.014pp (-0.34%) – US10Y price live, US10Y实时

- US30Y: 4.788% (day 4.767%–4.824%), -0.028pp (-0.58%) – US30Y price live, US30Y实时

- DXY: 96.692 (-0.02%) – DXY live chart

- VIX: 17.21 (-2.49%)

- WTI: 64.17 (-0.71%) – WTI price live, WTI realtime

- Gold: 5083.67 (-0.29%) – gold price, gold live chart

Related Reading

- Long Bond Leads Amid Soft Data, Signalling Term Premium Unwind

- Bond Term Premium Returns: Supply Drives Yield Dynamics

- Bunds & Treasuries: Safe Haven Status Amid Fiscal Slippage

- OATs Quiet: Term Premium Unwind Drives European Bond Dynamics

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.