Gilts: UK Rates Face Political Scrutiny Amid Macro Headwinds

UK Gilts are acting as a hybrid asset, influenced by both global rates and domestic political factors, leading to amplified volatility and a persistent risk premium amidst a 'high beta' duration...

The UK Gilt market is currently a complex interplay of global economic trends and domestic political narratives. Far from behaving as a straightforward interest rate instrument, gilts are reflecting a 'high beta' duration sensitivity, particularly affected by perceived fiscal instability and the Bank of England's cautious stance on inflation.

Gilts: Navigating Global Anchors and Domestic Credibility

In recent sessions, UK borrowing costs have exhibited a pronounced sensitivity to political headlines. This is not to suggest fragility unique to the UK, but rather highlights that in a world of elevated nominal rates, the tolerance for policy uncertainty is significantly reduced. When investors perceive a lack of clarity regarding fiscal direction, the Gilts: Westminster Noise vs Global Gravity in Bond Markets can reprice with a speed that macro data alone might not justify. This demonstrates how bond markets are not solely driven by economic fundamentals but also by the 'trust function' placed in governmental policy.

The market snapshot as of February 13, 2026, shows a global context where US 10s are at 4.109%, German 10s at 2.76%, and UK 10s at 4.43%. Emerging markets like Brazil (13.587%) and Russia (14.63%) also reflect diverse rate environments. Cross-asset indicators, such as the DXY at 97.039, VIX at 21.11, and WTI at 62.71, further paint a picture of a dynamic global landscape influencing the Bond Market: Liquidity's Dominance & The Microstructure Trap. Notably, Gold is trading at 4972.41, indicating a sustained bid for safe-haven assets.

Understanding the UK Rates Landscape: Three Key Layers

Our analysis breaks down the behavior of UK rates into three interdependent layers:

- Global Anchor: US CPI and Fiscal Term Premium. The UK bond market remains heavily tethered to global duration movements. If US Treasuries experience significant shifts, gilts typically follow, but often with an amplified reaction. This linkage means that global economic trends, particularly in the US, continue to play a pivotal role in shaping local UK rates.

- Domestic Credibility: Fiscal Policy and Political Stability. This layer is critical. Any signal that fiscal discipline might be weakening tends to impact long gilts and the sterling risk premium first. This channel has gained significantly more importance than during the prior era of near-zero interest rates, reflecting a heightened sensitivity to sovereign creditworthiness. The Fed Independence Risk Premium: The Quiet Bid Under Long Bonds, while US-centric, highlights a similar credibility component at play in fixed income markets.

- BoE Reaction Function: The '2.5% Underlying' Floor. The Bank of England's messaging, particularly comments from officials like Huw Pill about underlying inflation sitting around 2.5%, serves as a constant reminder that the central bank remains vigilant against inflationary pressures. This sets a 'floor' for market expectations. If the market aggressively prices in too many rate cuts too quickly, it risks an abrupt correction, often due to carry-driven positioning in UK duration. Such corrections are often linked to the US January Deficit: Tariff Boost Amidst Rising Interest Costs, as fiscal burdens can translate into higher inflation expectations and bond yields.

Tactical Considerations and What to Watch Next

For traders interacting directly with gilts, it's prudent to approach them as a “high beta” duration instrument until political noise subsides. This means expecting larger price swings relative to global benchmarks. For those seeking UK exposure while mitigating domestic headline risk, relative value strategies against Bunds or Treasuries might offer a more stable approach.

The long end of the gilt curve requires particular attention. If 20Y and 30Y gilts materially cheapen relative to their peers, this suggests the market is actively charging a credibility premium, discounting future fiscal stability. The current Bond Term Premium Returns: Supply Drives Yield Dynamics narrative is particularly relevant here, as increased supply coupled with uncertainty can amplify yield movements.

Key indicators to monitor include any forthcoming fiscal statements or budget leaks that could reshape borrowing expectations. Speeches from BoE officials will be crucial to whether they reinforce a 'slow and cautious' monetary policy stance. Furthermore, cross-asset correlations are important: sustained choppiness in equities and continued bids for gold could drive global duration demand, temporarily offsetting UK-specific risk premiums.

Gilt Curve Character and Prerequisites for a Rally

In this volatile regime, the UK gilt curve exhibits distinct characteristics across its segments:

- Front-end: Generally anchored by the BoE's cautious approach to monetary policy.

- Belly: More responsive to global risk sentiment and significant economic data releases like US CPI.

- Long-end: Highly sensitive to domestic political developments and long-term fiscal signaling.

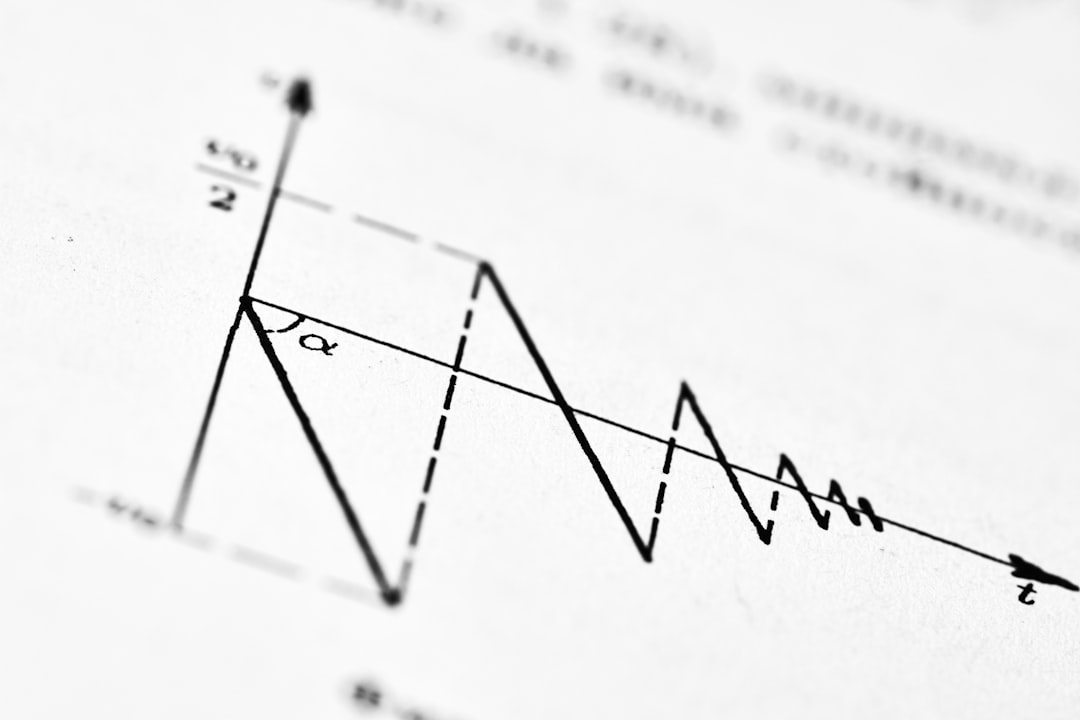

This dynamic explains why 10Y gilts might appear calm while 30Y gilts experience sharp repricing—the market is discerning between immediate policy effects and long-term credibility concerns. For a genuine, sustained rally in gilts, several conditions would need to materialize: a consistent decline in services inflation and wage growth, a clear shift in BoE communication towards confidence in meeting inflation targets, and a fading of political headlines that allows gilts to trade predominantly on their fundamental duration characteristics. Until these elements align, gilts will remain a tradable but inherently complex instrument, requiring careful risk management against domestic headline risk.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.