US Treasuries Bull-Flatten: Retail Sales Spark Policy Repricing

A soft retail sales report in the US has triggered a 'bull-flattening' in the Treasury yield curve, indicating a market repricing of the near-term Federal Reserve policy path amid growth concerns...

The US Treasury market experienced a notable 'bull-flattening' in its yield curve, driven by a softer-than-expected retail sales report. This orderly, risk-off impulse suggests a swift repricing of the Federal Reserve's near-term policy trajectory, reflecting concerns about economic growth cooling without signaling outright recessionary stress.

Retail Sales Drag US Treasury Yields Lower

The latest Reuters flagging of flat December retail sales acted as the immediate catalyst, sending US Treasury yields lower across the board. The market's reaction, characterized by the 'belly' (5-year Treasury) and 'long-end' (10-year and 30-year Treasuries) leading the decline in yields, suggests investors are quickly adjusting their expectations for future interest rate cuts. At the close of today's snapshot, the US 10Y Treasury was trading around 4.140%, marking a significant drop, while the 30Y Treasury also saw its yield fall to 4.783%.

The yield curve, specifically the 2s10s spread, remains positively sloped near 68.8 basis points, and the 10s30s spread around 64.3 basis points. This positive slope is crucial, as it indicates the market is primarily focused on the sequencing debate of how quickly the Fed can ease policy without reigniting inflation, rather than pricing in deep recession stress. The measured nature of the yield decline, without a spike in volatility (VIX at 17.61, a modest increase), points to real-money duration bids, suggesting a sustainable shift in market sentiment.

Why the 5-Year Sector Holds the Key

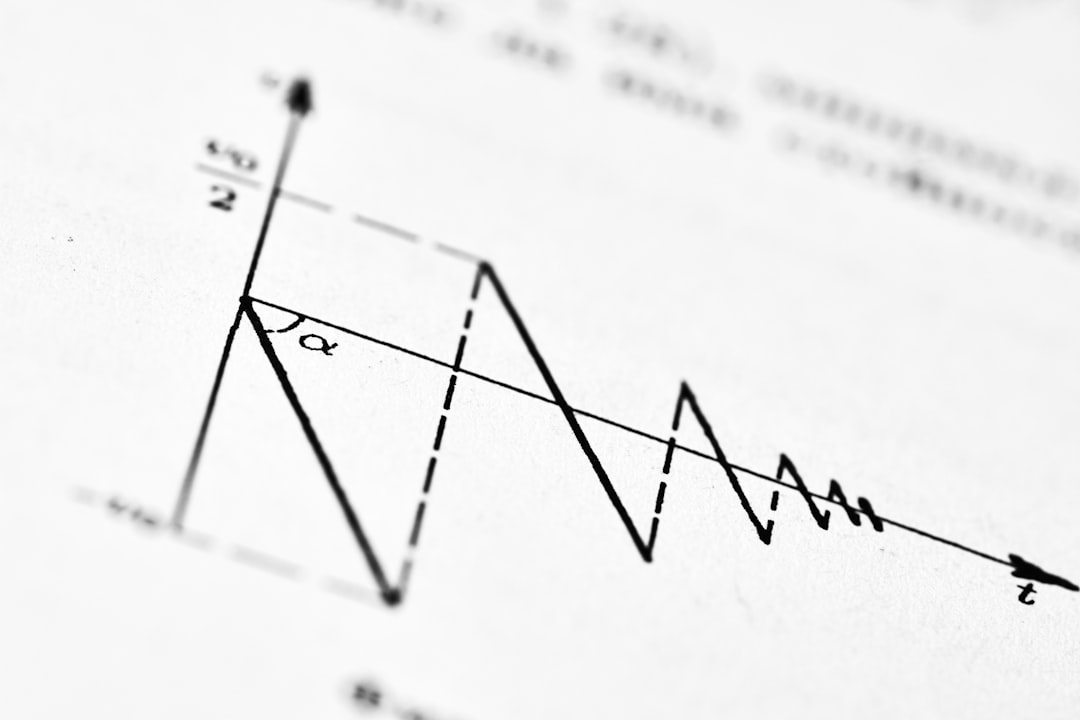

The 5Y Treasury sector is a critical barometer where expectations for policy and growth intersect. When the 5Y outperforms, it signals that the market anticipates an easier policy stance from the Federal Reserve over the next 12 to 24 months. This can occur even as the long-term neutral rate remains a topic of debate among economists and policymakers. Observing the behavior of the 2Y versus the 10Y is essential: if the 2Y's decline lags the 10Y's, it hints at a transition from a pure policy story to one dominated by growth concerns. Conversely, if the 2Y falls faster, it's a clear signal of aggressive policy repricing.

Flows, Positioning, and the 'Good Slowdown' Narrative

The sustainability of this bond rally hinges on several factors, including the supply calendar, convexity hedging activity, and existing investor positioning. A key tell is the response to oil prices; a softening energy market, like the current WTI at 64.28, eases headline inflation pressure, which tends to support duration rallies. However, a significant rebound in crude oil that pushes breakevens higher could quickly interrupt such a rally. The DXY price live is stable, further supporting the 'good slowdown' narrative where economic growth moderates without financial market distress.

A 'good slowdown' characterized by consumers pivoting from goods to services and growth cooling orderly is supported by stable credit spreads, resilient equities, and a consistent demand for duration. This aligns with today's cross-asset tape: VIX is contained, the dollar is steady at 96.87, and oil is softer. In contrast, a 'bad slowdown' would manifest through widening credit, a stronger dollar (DXY price realtime on the rise), and a disorderly flight to long-duration assets. Observing whether the rally is led by the belly (policy repricing) or the long-end (growth hedges) will provide further clarity on the market's conviction.

Tactical Outlook: Yield Levels and Trade Construction

The pivot point for the US 10Y Treasury is identified at 4.161%, with a decision band ranging from 4.144% to 4.178%. Movement above 4.178% would signal renewed duration pressure, potentially testing the 4.189% level. Conversely, a sustained move below 4.144% would reinforce the duration bid, eyeing the 4.133% mark. Traders employing illustrative strategies might consider a bull-flattener, such as a long 5Y versus short 2Y position, contingent on continued market repricing of Fed cuts.

The strategic framework also considers risk scenarios. The base case suggests a marginal cooling of data, extending policy repricing with contained volatility. Alternative scenarios include inflation reasserting itself or a hawkish pushback from the Federal Reserve, leading to front-end rate hikes and a steepening curve. A tail risk involves a significant risk-off shock, causing yields to gap lower, accompanied by thinning liquidity and widening spreads. Key catalysts to monitor include upcoming Treasury auctions, equity volatility, the dollar trend, and specific Federal Reserve communications. Gold realtime and WTI realtime are also crucial indicators.

The market will be keenly watching Fed communication for any indications of pushback against easier financial conditions. The outcomes of upcoming Treasury auctions will reveal the depth of demand, particularly from foreign and real-money investors. Additionally, equity leadership dynamics, especially if cyclicals outperform as yields fall, could provide early warnings for the bond rally. Finally, changes in curve shape (beyond just level changes) and cross-market spreads (Bunds vs Treasuries, Gilts vs Bunds) will be crucial in signaling regime shifts. XAUUSD price live and gold live chart will continue to be closely monitored for broader risk sentiment. Overall, today’s move rewarded patience, but future gains will demand greater discipline.

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.