Greenland NATO Framework Flips Market Tape: A New Risk Regime

Following a major geopolitical framework announcement regarding Greenland and NATO, global markets witnessed a dramatic compression of risk premia across equities, yields, and crypto.

The shift in global market dynamics was on full display following a pivotal geopolitical headline regarding a Greenland "NATO Framework." This single event rewired risk appetite across equities, rates, and digital assets in minutes, proving that geopolitics is no longer noise—it is the primary driver of the current market regime.

The Greenland Narrative: Resetting the Risk Premium

The announcement from the Trump administration regarding a deal framework for Greenland following meetings with NATO leadership triggered an immediate cross-asset repricing. The core interpretation for traders was a reduction in European tariff threats and near-term escalation risks. In this environment, when uncertainty falls, the uncertainty discount or "risk premium" compresses rapidly.

This led to a coordinated but nuanced market move: equities surged, yields softened, and cryptocurrencies rallied. However, the performance of gold versus silver highlighted that while risk became "cheaper," the market remains far from a state of total ease.

Equities and Earnings: Relief Over Fundamentals

The rally in major US indices was less about a sudden shift in corporate fundamentals and more about a "macro relief" trade. Indices closed significantly higher as the market priced in "less chaos than feared."

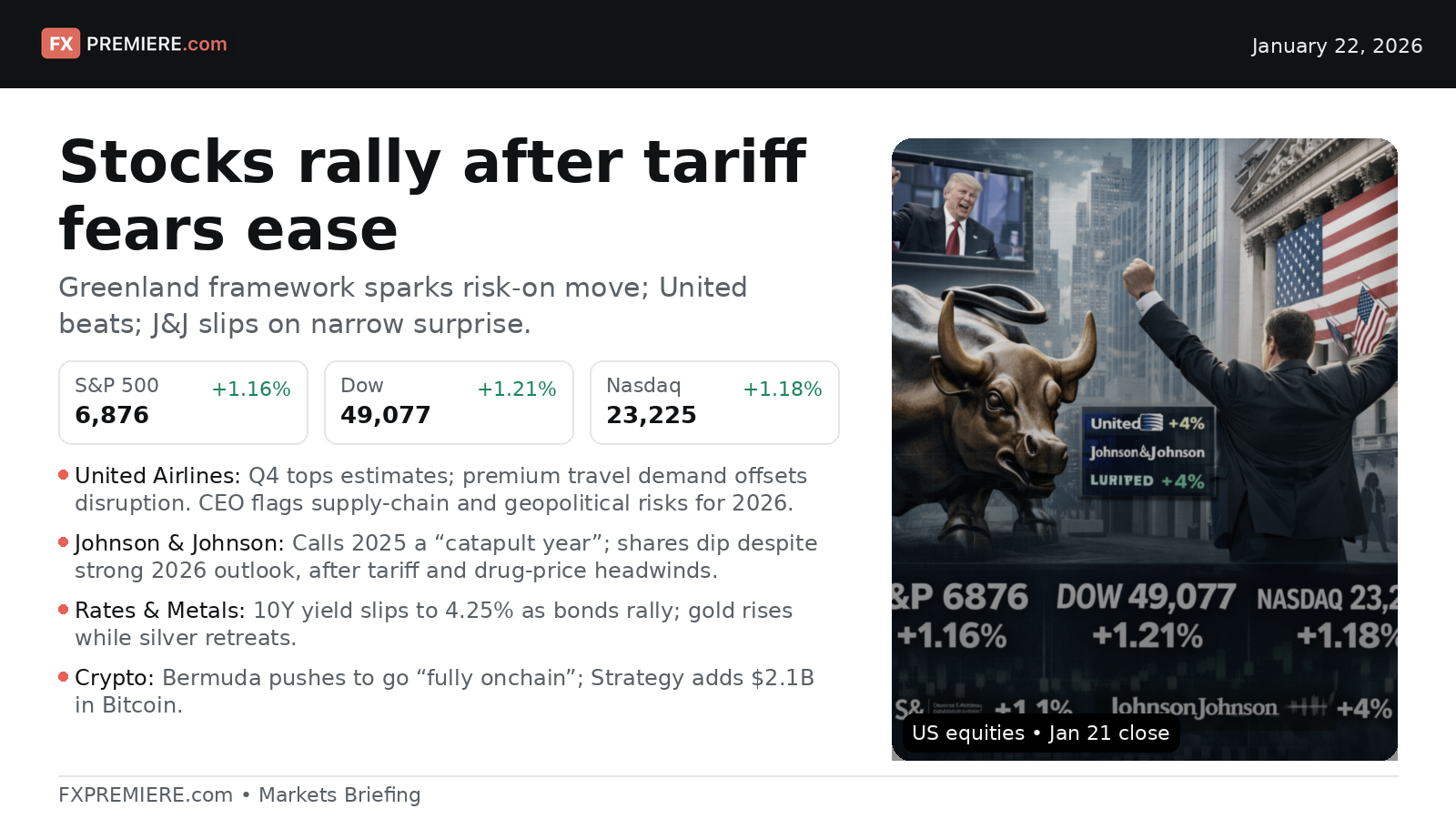

- S&P 500: 6,876 (+1.16%)

- Dow Jones: 49,077 (+1.21%)

- Nasdaq 100: 23,225 (+1.18%)

Corporate signals reinforced this complex backdrop. While United Airlines (UAL) beat estimates on strong travel demand, leadership remains cautious regarding 2026 supply chain tensions. Similarly, Johnson & Johnson (JNJ) highlighted the impact of tariffs and price caps, suggesting that markets are no longer rewarding "good" results in isolation but rather performance that exceeds a high uncertainty threshold.

Fixed Income: Yields Signal Fewer Shocks

The US 10-year Treasury yield drifted to 4.25%, a move typically associated with safe-haven buying. However, in this specific context, falling yields alongside rising stocks suggest a reduction in tail-risk hedging. The market isn't necessarily celebrating expansion; it is pricing in a lower probability of immediate systemic shocks.

Metals Divergence: Gold as Structural Insurance

A striking takeaway from the recent session was Gold ($4,837, +1.58%) gaining while Silver ($93.20, -1.61%) fell. In a traditional risk-on environment, gold should have faded. Its resilience suggests that the "insurance demand" remains structural. Silver, acting as a high-beta industrial hybrid, suffered as traders de-levered from more volatile assets while maintaining a core hedge in gold. This is a classic symptom of a fragmented risk tape.

Crypto Institutionalization and Geopolitical Shifts

Bitcoin (BTC) pushed back toward the $90,000 level, supported by a mix of macro relief and institutional adoption news. From Bermuda's move to go "fully on-chain" to massive balance-sheet additions from major corporate players, the narrative is shifting from retail speculation to institutional signaling. The market is increasingly viewing digital assets through the lens of sovereign and balance-sheet behavior.

The AI-Energy Nexus and Policy Intervention

Beyond the immediate headlines, structural shifts are occurring in the energy sector. Japan's restart of nuclear reactors underscores a global reality: AI and data center growth are turning energy into a strategic constraint. Simultaneously, domestic policy risks—ranging from proposed credit card APR caps to restrictions on institutional housing purchases—are becoming direct inputs into consumer credit and real estate valuations.

As we navigate January 2026, traders must realize the rules have changed. Geopolitical headlines now carry the same weight as CPI prints, and relief rallies are often just the market sighing in relief rather than a call for sustained growth.

Related Reading

- United Airlines (UAL) Q4 Earnings Analysis: Demand Mix & Fuel Costs

- Johnson & Johnson (JNJ) Q4 Earnings Analysis: Guidance and Sector Risk

- Bitcoin Analysis: BTC Trading Strategy Near $90,000 Decision Level

Frequently Asked Questions

Related Analysis

The Cost of Resilience: Reshoring, Stockpiling & Market Impacts

Explore how policy-driven reshoring and stockpiling are reshaping real economy costs, market dynamics, and risk across manufacturing, commodities, and credit markets.

Sector Rotation: Why Quality Cyclicals Trump Duration Now

Amid sticky rates and geopolitical noise, the market is favoring quality cyclicals with strong balance sheets and policy visibility over duration plays. This shift is driven by a combination of...

Crypto Markets: Navigating Policy, Liquidity, and Valuation Reset

Bitcoin and Ether are trading in an environment heavily influenced by policy discussions, particularly around stablecoins, and evolving macro liquidity conditions. Understanding these intertwined...

Central Bank Divergence: Navigating Global Policy Shifts

Amidst noisy data, central banks communicate more than they act. The RBA's recent hike, the PBOC's liquidity management, and the ECB's cautious stance highlight a growing policy divergence that...