Oil's Risk Premium: Energy as a Global Macro Constraint

Oil is evolving from a simple inflation input into a structural macro constraint, forcing a repricing of global risk premia and central bank policy expectations.

As we move into early 2026, crude oil is no longer behaving as a mere industrial commodity; it has evolved into a formidable macro constraint. When the market assigns a persistent geopolitical risk premium to energy, it effectively tightens global financial conditions, regardless of whether underlying growth data remains steady.

The Behavioral Shift: From Fading to Respecting Spikes

The most significant change in the current regime is behavioral. In a slack market characterized by oversupply, investors typically fade price spikes. However, in our current constrained environment, market participants are forced to respect these moves because even minor logistical disruptions now carry significant weight. This shift establishes a higher volatility floor and triggers more frequent correlation shocks across asset classes. For traders monitoring the WTI realtime data, the sensitivity to supply-chain friction has become the primary driver of price action.

Cross-Asset Transmission Channels

The impact of energy pricing extends far beyond the pits. In the rates market, sustained oil support keeps the inflation tail alive, making central bank policy easing increasingly conditional. We see this reflected in the bond markets, where term premiums are being reassessed. Furthermore, the WTI live rate often serves as a leading indicator for shifts in inflation expectations, directly affecting how the Fed and ECB approach the "last mile" of price stability.

In the equity space, leadership is rotating toward companies with cash-flow reliability, while input-sensitive cyclicals face mounting margin risks. Analysts utilizing a WTI live chart to hedge equity exposure are noting that the traditional inverse correlation between energy and stocks is becoming more complex, particularly as energy costs act as a tax on consumer discretionary spending.

Forex and Credit Market Implications

Foreign exchange markets are seeing increased dispersion. While energy exporters may find temporary support, the USD often strengthens as global risk tightens, creating a "double squeeze" for emerging markets. Those tracking WTI price live fluctuations alongside major pairs like EUR/USD are witnessing how energy costs can abruptly reprice local risk premies. Traders should consult a WTI chart live regularly to identify when energy prices begin to decouple from standard risk-on/risk-off sentiment.

Credit markets are also feeling the heat. Heightened energy uncertainty tends to widen risk premia, making corporate issuance windows more fragile. It is essential to treat energy as a macro variable that reprices policy expectations rather than a standalone commodity view. Monitoring a WTI live chart in conjunction with credit spreads provides a more holistic view of systemic stress than looking at either in isolation.

What to Watch Next

Crucial triggers for the coming weeks include whether oil prices rise on days when equities are down—a classic sign of a supply-side shock—and if front-month volatility begins to spike. Additionally, signs of inventory tightness paired with shipping friction will be paramount. For technical levels and execution, the WTI price live dashboard remains the single source of truth for intraday triggers. As indicated in our recent Crude Oil Strategy, the 66.11 resistance level remains a critical pivot for the medium-term outlook.

Related Reading

- Crude Oil Strategy: Trading the 66.11 Resistance and USD Headwinds

- Shipping as the Hidden Inflation Input: The Physical Economy Channel

- Inflation Nowcasting: Tracking Daily Estimates Ahead of CPI and PCE

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

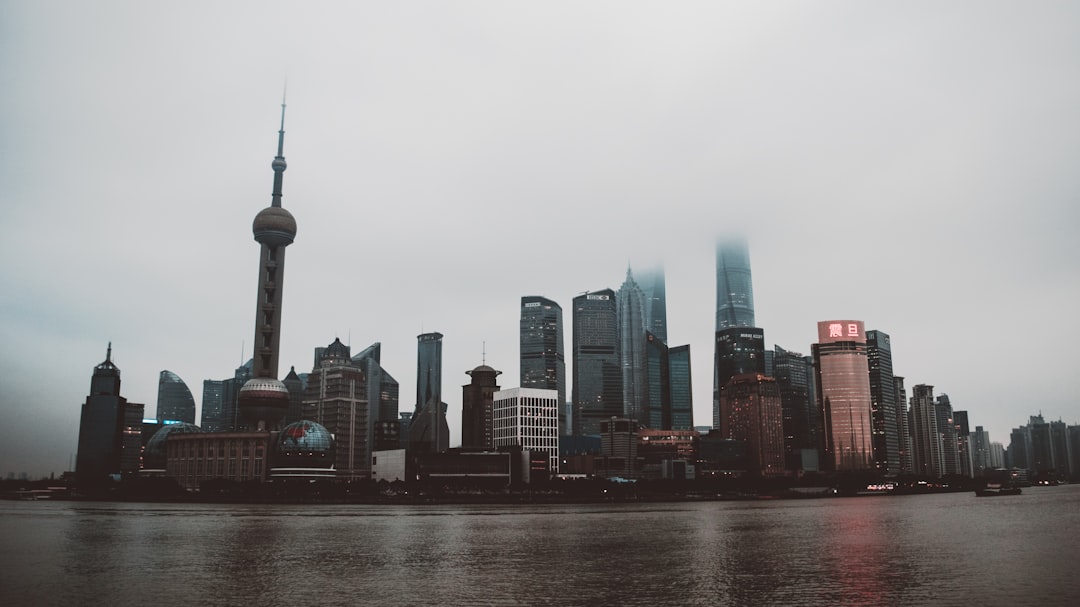

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.