US 2-Year Treasury Repricing: Policy Bet or Economic Downturn?

The US 2-year Treasury yield is experiencing significant repricing, indicating a market leaning towards Fed easing rather than a recessionary outlook. Understanding the dynamics of this front-end...

The US 2-year Treasury yield, often considered the most direct barometer of Federal Reserve policy expectations, is undergoing a notable repricing. Current market moves suggest a strong conviction towards an easing path from the Fed, rather than an outright recessionary call, with the US 2Y Treasury realtime reflecting this sentiment.

Policy Expectations and the 2Y Treasury

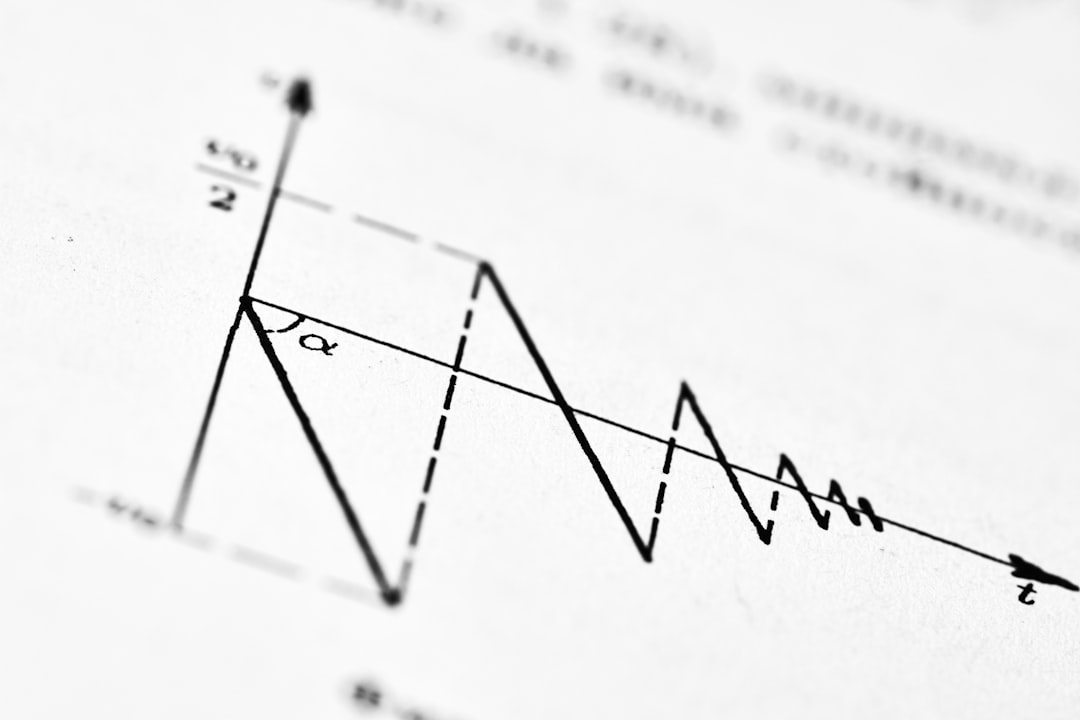

Today's trading saw the US2Y price live move lower in yield, signalling that market participants are front-loading expectations for Fed rate cuts. This behaviour is consistent with recent trends showing softer growth momentum and inflation that is no longer accelerating. However, the crucial distinction here is between a 'policy bet' — where the market anticipates central bank action — and a 'recession call,' which implies a more dire economic outlook. The rapidity of this repricing is a key factor, as fast shifts in the US 2Y Treasury live rate typically require validation from persistent inflation surprises, significant labour-market weakening, or explicit forward guidance from the Fed. Without such fundamental backing, these front-end moves can be prone to quick reversals, particularly if the Fed itself pushes back against prematurely easier financial conditions.

The Nuance of Repricing Speed

The current 2s5s spread, hovering around 24.4 basis points, suggests that the front-end of the curve is indeed doing the heavy lifting in this repricing scenario, indicating a market belief that short-term rates will fall faster than intermediate-term rates. This dynamic is closely watched by investors tracking the US 5Y Treasury live chart and US 10Y Treasury chart live for broader curve implications. A snapback in the front-end could be triggered by several factors: a resurgence of inflation risk, a clear signal from the Fed indicating more patience than currently priced in, or a sustained rally in risk assets that might prompt the Fed to worry about easing too soon. Any one of these catalysts could be enough to force a quick repricing if market positioning is heavily skewed in one direction.

Hedgers vs. Speculators and Market Signals

The interplay between different market participants provides additional insights. Corporate treasurers and liability managers often engage in hedging short-term interest-rate exposure when they perceive value in the front-end. Meanwhile, macro funds tend to express their policy views through the belly of the curve. If the belly consistently outperforms the 2-year, it often suggests that speculators are driving the narrative. Conversely, if the 2-year leads the move and sustains its trajectory, it indicates active participation from hedgers. For traders, this implies that front-end movements, while capable of being sharp, are frequently mean-reverting. Success often comes from acting decisively when the initial thesis appears correct.

Asymmetric Policy Path Risk

The front-end of the yield curve presents an asymmetric risk dynamic. The Fed has the flexibility to pause its tightening or easing cycle, but it cannot easily accelerate rate cuts without compelling reasons that the market deems legitimate. This asymmetry allows the market to aggressively price in cuts, only to be forced into a rapid repricing if a single piece of sticky inflation data emerges. The most common pitfall is overreacting to individual data points. A more robust approach involves monitoring the sequence of inflation, employment trends, and financial conditions. Should financial conditions ease independently, the Fed might verbally intervene, a move often sufficient to push the US 2Y Treasury price higher.

Tactically, a sustained rally in the front-end is best confirmed by stability in swap spreads and funding markets. When funding conditions are calm, front-end moves are more likely to reflect genuine policy expectations rather than technical stress in the financial system. Therefore, closely observing these metrics alongside the US 2Y Treasury price live remains paramount.

Tactical Map and Trade Considerations

Current yield levels suggest a pivot around 3.465%, with a decision band between 3.455%-3.474%. A move above 3.474% would indicate renewed duration pressure, with 3.481% as the first reference point, potentially leading to concessions into new supply. Conversely, a break below 3.455% would signal a duration bid, targeting 3.448% for follow-through as volatility compresses. A 'failed-break rule' here would involve a brief breach, a re-entry into the band, and holding for a specified period before fading back to the pivot.

For illustrative trade construction, consider a front-end range trade within the decision band, employing tight stops given the mean-reverting nature of front-end moves without strong policy validation. Alternatively, for those anticipating Fed pushback against current easing expectations, a conditional steepener like a 2s10s trade might be preferable to an outright short 2-year position. This strategy limits losses if growth data weakens and pulls the entire curve lower. The overarching theme is that the market currently anticipates a smoother economic landing than what might be headline-grabbing. Should this assumption falter, expect curves and spreads to adjust far more rapidly than market narratives.

Calendar and Catalysts Ahead

Key events to watch include the upcoming statements from Fed speakers, particularly if their messaging leans against current market pricing for rate cuts. Cross-asset dynamics, such as equity volatility and the trend in the Dollar Index (DXY), will serve as proxies for broader risk appetite. Additionally, the next inflation print and any revisions, especially concerning core services components, will be critical data points. Auction tails and bid-to-cover ratios in funding markets will offer an objective stress dashboard, while cross-market spreads (Bunds vs Treasuries, gilts vs Bunds) will indicate how different bond markets behave under risk-off conditions. These elements collectively inform the ongoing analysis of the US 2Y Treasury realtime position and future trajectory.

Related Reading

- The Dollar's Quiet Pivot: Macroeconomic Shifts and FX Flows

- US Treasuries Bull-Flatten: Retail Sales Spark Policy Repricing

Frequently Asked Questions

Related Analysis

Italy & Spain Bond Carry: Navigating Risks with a Trigger Map

Investors are drawn to the attractive carry offered by Italy's and Spain's 10-year bonds compared to German Bunds. This analysis provides a trigger map for managing the inherent risks in these...

Bond Markets: Why Supply Auctions Are the New Macro Indicator

In 2026, with inflation cooling but not collapsing, bond market dynamics are increasingly dictated by supply schedules and auction results, rather than traditional economic calendar releases.

France's OAT Bonds: Budget Passed, But Real Test is Next Supply Window

France's 2026 budget passage has reduced immediate political uncertainty, but the real test for its OAT bonds lies in upcoming supply auctions and how the market prices fiscal risk.

US Treasury Curve Analysis: The Belly Does the Work

This analysis delves into the current shape of the US Treasury curve, highlighting the outperformances of the belly amidst expectations of Federal Reserve policy easing.