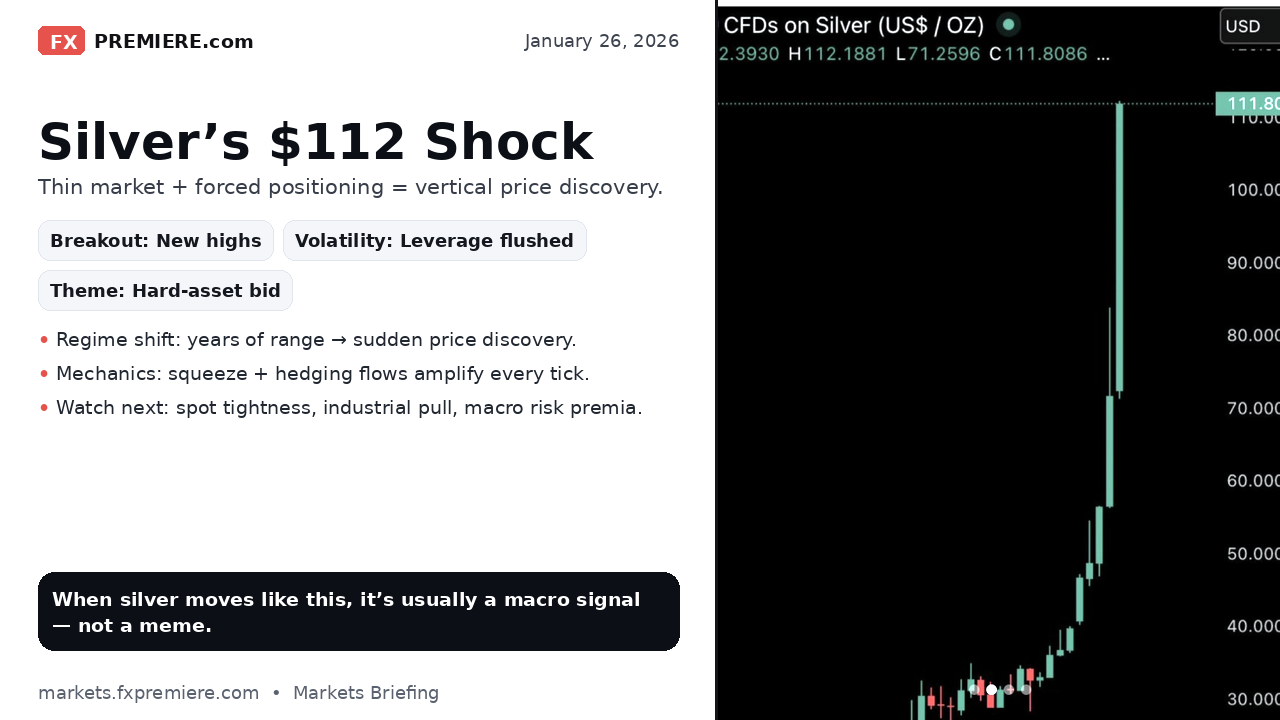

Silver’s $112 Shock: Trading the Crisis Asset Regime Shift

Silver has entered a parabolic regime change, surmounting the $112 level as positioning and industrial demand ignite a historic squeeze.

Silver has transitioned from a traditionally range-bound industrial metal into a high-velocity crisis asset, recently shock-testing the $112 per ounce threshold in a move that signals a fundamental regime change.

The speed of this ascent is the primary narrative. Within the current macro environment, the XAGUSD price live feed has shown volatility that suggests a massive forced positioning move rather than simple retail speculation. Market participants are witnessing a near-doubling in price over a matter of weeks, forcing a violent acceptance of new value areas. For those tracking the XAGUSD chart live, the technical breakout above long-term resistance gates has turned into a 'teleportation' of price, fueled by the metal's dual personality as both a monetary hedge and a critical industrial input.

The Mechanics of a Vertical Squeeze

This historic move in the XAGUSD live chart is being driven by a classic liquidity cascade. Silver is a notoriously thin market compared to gold, and when the spring snaps, the results are often non-linear. First, short positions that were accumulated during years of sideways grinding find themselves trapped with no exit liquidity. As the XAGUSD realtime data flashes new highs, dealer delta-hedging turns into a one-way accelerant, further tightening the squeeze.

Furthermore, the XAGUSD live rate is reflecting a scramble among industrial consumers. With silver being a vital component in solar energy, electronics, and grid electrification, manufacturers are being forced to adjust their coverage in a compressed window. Because silver production is largely a byproduct of copper and lead mining, supply is inelastic; higher prices do not immediately result in new ounces hitting the market, leaving the silver live chart vulnerable to extreme upside extensions.

Macro Implications and Structural Demand

If silver price behavior continues to mimic a momentum-driven crisis asset, it often precedes broader shifts in the global financial system. According to our recent Gold and Silver Regime Analysis, these metals often reprice when market participants begin to question terminal inflation risks or institutional credibility. While silver chart patterns show extreme overbought conditions, the structural backdrop of supply deficits and electrification demand remains sticky.

The silver live narrative is also a warning regarding fragile liquidity. When a real commodity reprices with this much violence, it forces downstream adjustments across equities and credit markets. We are seeing a scenario where "gold headlines, but silver provides the violence," a common theme when leverage becomes the primary driver of price action. Traders monitoring the silver price must now determine if the market can hold this breakout or if a mean-reversion event is looming.

The 2026 Outlook: Three Critical Questions

As we move forward into the first quarter of 2026, the permanence of this move rests on three factors:

- Positioning Retention: Does the market maintain acceptance above previous resistance, or do we see a liquidation back to the $80-90 range?

- Industrial Elasticity: Will the pace of solar buildouts and high-spec manufacturing sustain consumption at these elevated levels?

- Macro Risk Premia: Does silver continue to trade as a high-beta version of the Gold safe-haven regime?

Bottom line: Silver doesn’t whisper; it snaps. When a boring metal starts trading like a crisis asset, it’s a signal that the macro spring was wound much tighter than the consensus realized.

Related Reading

- Gold and Silver Trading the Regime: Beyond Macro Variables

- Gold Strategy: Safe-Haven Regime Accelerates Above $5,000

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.