The Correlation Trap: Why Diversification Fails in 2026

Discover why traditional diversification fails during correlation spikes and how to manage portfolio fragility in the current market regime.

In the current financial landscape, most portfolios are built on perceived relationships between asset classes rather than the inherent value of the assets themselves. This creates a hidden vulnerability: the correlation trap, where diversification vanishes exactly when it is needed most.

When Diversification Becomes Fragile

The real risk in 2026 is unintentional correlation. When these metrics spike, the safety net of a balanced portfolio disappears. More dangerously, when correlations flip, the very hedge you relied on can transform into your primary source of risk. For those monitoring EURUSD price live or equity indices, the sudden realization that assets are moving in lockstep can be catastrophic for risk management.

In the current market regime, correlations shift rapidly because the underlying driver of fear fluctuates with high frequency. During growth scares, we typically see bonds rally while equities decline. However, in an inflation-driven environment, both can plummet simultaneously. This is a critical time to maintain a EUR USD chart live to see how currency movements are reacting to these macro shifts in real-time.

Cross-Asset Implications and Risk Premia

The relationship between US Treasuries and other assets is currently under immense pressure. For example, duration may offer less of a hedge when the term premium rises. We have seen similar dynamics in the bond market where global yields reset after shocks, often leaving investors exposed despite their spread-out positions. Keeping an eye on EUR USD realtime feeds can help traders identify when the Dollar is acting as a refuge versus merely a transmitter of global uncertainty.

Equities are facing their own challenges as factor dispersion increases. High-multiple exposures are increasingly fragile, especially when the EUR/USD price live suggests a strengthening greenback that could pressure international earnings. Traders should consult the EUR USD live chart to identify the exact moments when currency volatility starts to bleed into equity factor performance.

Strategic Structural Risk Management

The uncomfortable truth of the 2026 market is that you can be highly diversified across dozens of tickers and still remain structurally fragile. If your strategy relies on a single correlation remaining stable, such as the historical inverse relationship between the 10-year yield and growth stocks, you are at risk. Monitoring the EUR to USD live rate alongside EURUSD price live data provides a window into how the euro dollar live is pricing in these structural shifts.

To stay ahead, watch the rate-equity correlation during the next market shock and pay close attention to the volatility term structure. Often, quiet correlation stress is the leading indicator that a regime change is occurring long before it hits the headlines. Traders frequently use a EUR USD price tracker to gauge general sentiment, but the EUR USD price live action during low-volume hours can be even more telling of underlying rot in diversification strategies.

Related Reading

- The Term Premium Tax: Decoding Why Markets Feel Tighter in 2026

- Bond Market Analysis: Global Yields Reset After Gold Price Shock

- Trade Policy Uncertainty 2026: The New Macro Multiplier

Frequently Asked Questions

Related Analysis

Market Volatility 2026: Why High Variance Trumps Rate Levels

As we move into February 2026, the market obsession with interest rate levels is shifting toward a more dangerous metric: high variance and its impact on cross-asset correlations.

Politics as a Macro Factor: When Policy Uncertainty Becomes the Asset

In 2026, market participants must distinguish between economic noise and structural policy shifts that drive higher risk premia across all asset classes.

EU-India Trade Strategy: Assessing Supply Chain Infrastructure Value

Moving beyond sentiment, the EU-India trade alignment represents a multi-year rewrite of supply chains, standards, and capital flows for 2026 and beyond.

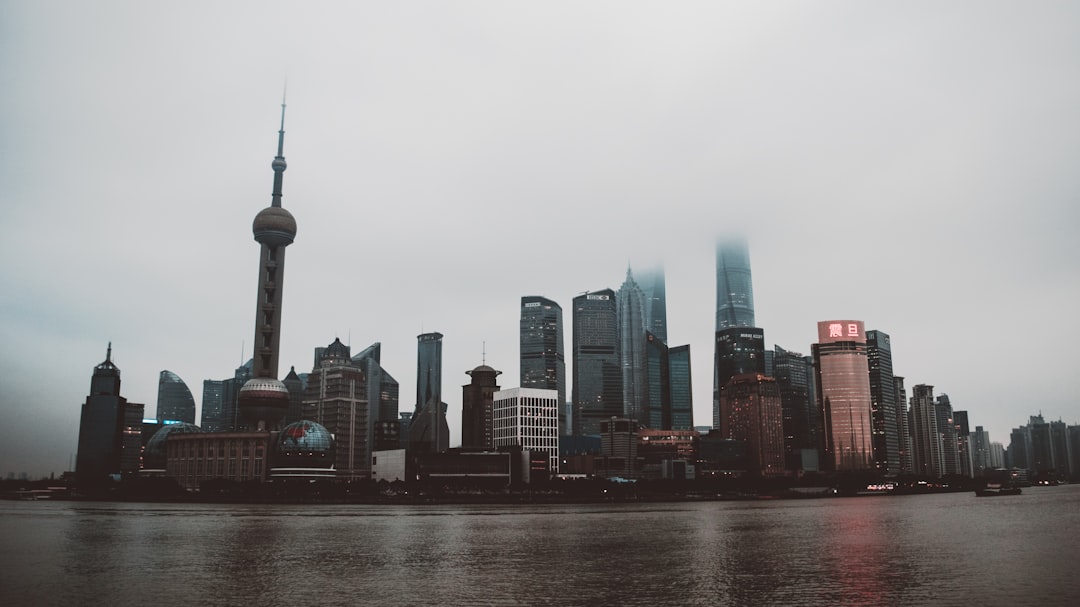

China's Two-Speed Reality: Strategic Growth vs Legacy Drag

Investors must pivot from binary 'on/off' China trades to a nuanced approach separating strategic manufacturing from legacy property sector stagnation.